The Kenya Revenue Authority (KRA) has registered an 18.7% increase in revenue collection for July compared to the same period last year. This growth is attributed to recent tax modifications and an increase in economic activity.

Data from the National Treasury indicates that the tax agency collected Sh155.06 billion in revenue last month, a substantial increase from the Sh130.6 billion gathered in July of the prior year.

July’s revenue intake surpasses that of six out of the twelve months in the 2022/23 fiscal year. However, it marks a 29.7% decrease from the record Sh220.6 billion collected in June. The rise in July’s revenue is propelled by the implementation of a new tax regulation that has increased the value-added tax (VAT) on fuel to 16%.

According to Business Daily despite the temporary suspension of this tax increment by the High Court, the Energy and Petroleum Regulatory Authority (EPRA) proceeded with the adjustment.

With the subsequent endorsement from the Court of Appeal for the implementation of the Finance Act, 2023, the KRA is faced with the task of achieving a tax revenue target of Sh2.49 trillion in the ongoing fiscal year.

President William Ruto’s principal aim is to generate sufficient tax revenue through fresh taxation and a broadened tax base to support his Sh3.67 trillion inaugural budget. The initial budget includes a fiscal deficit of Sh718 billion, to be addressed through domestic borrowing of Sh586.5 billion and external loans totaling Sh131.5 billion.

Read Also: KRA Implements Affordable Housing Levy Contributions

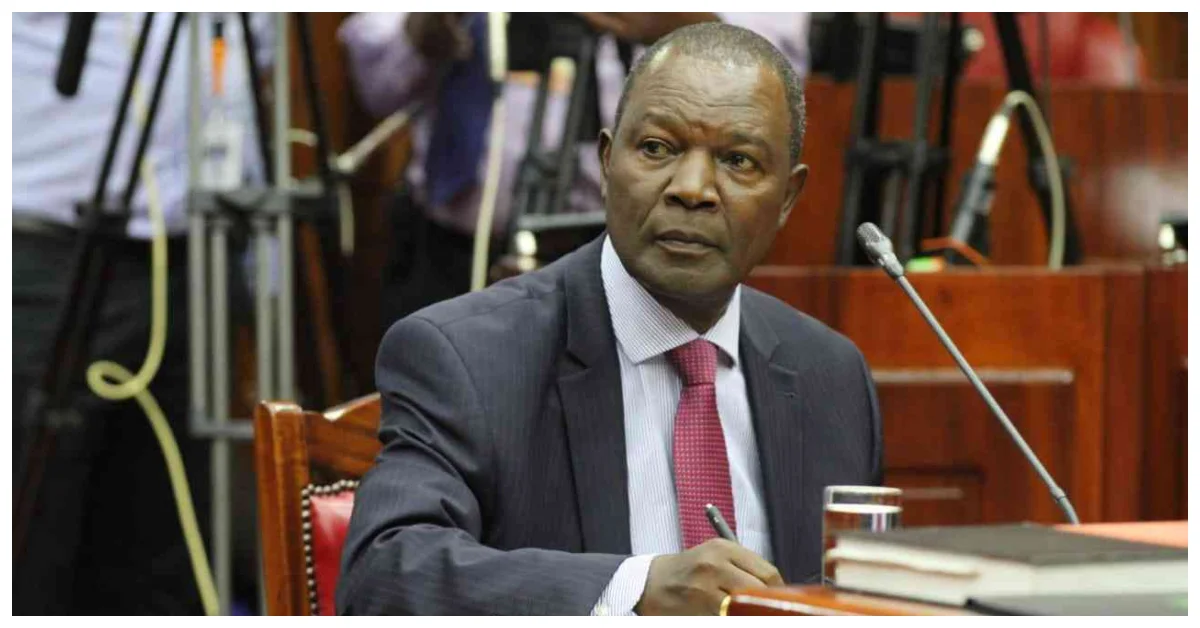

Additional disclosures from National Treasury Cabinet Secretary Prof Njuguna Ndung’u to the International Monetary Fund (IMF) suggest intentions to introduce further tax measures in the upcoming months to enhance revenue.

One such proposal involves the introduction of a motor vehicle circulation tax, entailing an annual registration fee for vehicle owners to access public roads. This potential tax implementation could significantly impact motorists, particularly given the current historically high fuel prices.

Prof Ndung’u stated that any revenue shortfall compared to program targets will be addressed through supplementary tax policies to meet program performance objectives. The Treasury also contemplates reducing exemptions on certain goods and services from VAT payment, along with a limitation on exemptions for government-paid interest.

Subscribe to Switch TV

These proposed tax measures are slated for presentation to Parliament for approval by the end of October, in conjunction with the first supplementary budget for the 2023/24 fiscal year.