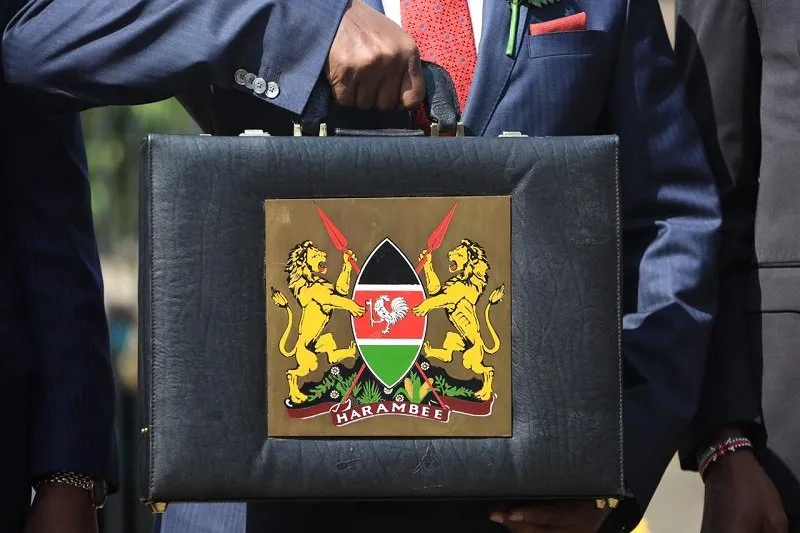

Kenya’s debt has hit an all-time high surpassing the debt ceiling

Kenya’s debt hit Ksh 10.027 trillion last week regardless of a statutory debt ceiling. The debt ceiling was set at Ksh 10 trillion by Members of Parliament last year.

This comes at a time when the debt servicing costs were set at more than two-thirds of the nation’s tax revenue.

The main cause of the increased borrowing over the last few months is the economic slowdown. With the increased cost of living and poor employment levels, the country has fallen short of its tax revenue collection targets.

According to CBK’s released statement on Friday, by June 23, 2023, the country had a debt of Ksh 4.711 trillion from domestic borrowing. In external borrowing as of April, the debt had reached Ksh 5.092 trillion. After April, the second tranche of a syndicated loan was released to Kenya in May, $ 600 million (Ksh 84.36 billion).

The debt has also excluded a possible release of the third tranche of $100 million (Ksh 14.06 billion). This syndicated loan is expected to be released in July according to the National Treasury.

The first tranche of the syndicated loan alongside the second and third was given to shore up foreign reserves. It came at a time when the country was running low on the dollar and it was affecting the nation’s economy. In response, they loaned Kenya $200 million (Ksh 28.12 billion ) in April.

The World Bank also issued Kenya a loan in May of $1 billion (Ksh 140.6 billion). Raising the external debt to Ksh 5.316 trillion in May. This excludes the probable disbursement of the third tranche of the syndicated loan.

Increasing Kenya’s debt to meet the 55 per cent anchor

With all these loans that have been supplied to the country, an all-time high of 10.027 trillion debt ceiling has been reached. Ignoring the 10 trillion debt ceiling retained in the 2022/23 financial year. The debt ceiling was also set in the Public Finance Management Act of 2012. Section 50 ( 2)limits government borrowing set by the parliament at the time.

Last year, the treasury called for an amendment to the act. Tabled in Parliament by the then National Assembly Majority Leader, Amos Kimunya the amendment was done. The debt ceiling would be exceeded in the event of fiscal disruptions. This includes wars, natural disasters

Last month, MPs decided to raise the ceiling debt from 10 trillion. Setting a new debt anchor to be limited the percentage of the GDP. After a push from the IMF, the debt anchor was set at 55 per cent of the country’s GDP. According to the public debt and privatization committee, they allowed a window of 5 per cent maximum to accommodate the current debt to GDP. A threshold of 60 per cent.

Subscribe to Switch TV

This breach comes after the president faces a menace with the economic situation of the country. With the current budget drafted by his government, the country’s expenditure is set at 3.68 trillion.

More than half of the country’s planned revenue from taxes is aimed at servicing the debts. Now, 70 per cent of the taxes collected, (2.57 trillion) will be directed to servicing the debts.

Read Also: State Officers Set to Receive Salary Increases in SRC Review