Somalia has launched the Quick Response Code Standard in an effort to compete with other countries in delivering secure payment services through banking and e-commerce apps.

Abdirahman Mohamed Abdullahi, Governor of the Central Bank of Somalia (CBS), stated on Tuesday that the SOMQR Code standards will allow businesses and shoppers to pay or receive transactions under a single system of parameters for the protection of users’ money.

“SOMQR Code Standard will revolutionize the payment landscape in Somalia as a low-cost, scalable, secure, and interoperable solution towards a cashless society,” said the CBS Governor to an audience in Mogadishu. Other countries in Africa that utilize the standardized code include Kenya and South Africa.

Mr. Abdullahi stated that Somalia should continue modernizing and digitizing national payment systems based on the concepts of connectivity, financial inclusion, and efficiency into a digital economy as a means of rebuilding from the lost years of violence.

The Central Bank said it aims to build stronger interconnections across all financial service providers in order to increase payment platform security and reliability, as well as tariff consistency.

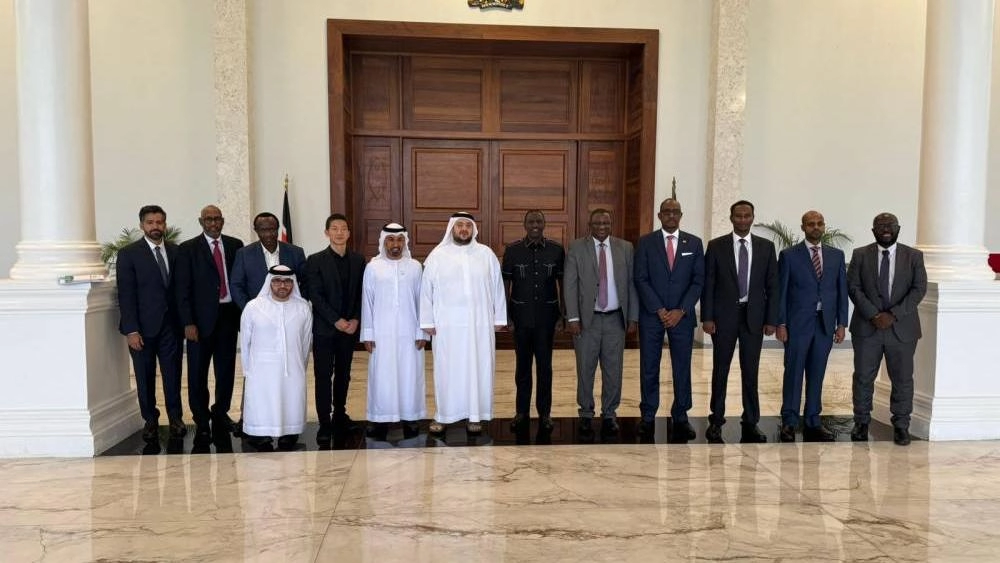

The CBS has developed an interconnection plan in partnership with the 13 licensed commercial banks.

Read Also: Kenya and Somalia agree to work closely in tackling insecurity in the region

“The close cooperation between the Central Bank of Somalia and 13 commercial banks under the Somali Bankers Association (SBA) set up a strategic payments company named Somali Payments Switch (SPS),” said Mr. Ahmed Shirwa, the chairman of SBA.

Somalia Payment Switch (SPS) will manage the national digital payments platform, it will connect banking, e-commerce, and mobile money payments to encourage users and merchants to use cashless payment methods.

The CBS, on the other hand, may need to work on reinstating its flexible shilling currency. Long subjected to falsification, the Somali shilling lost its appeal once conflict erupted and humanitarian agencies arrived.

Today, its exchange rate is almost unreliable, and most sections of Somalia refuse to accept it because it is impossible to differentiate genuine from the counterfeit.

Subscribe to our Youtube channel Switch TV

The Somali Parliament was set to debate a policy paper that, if approved, will define how the country’s currency is reintroduced.