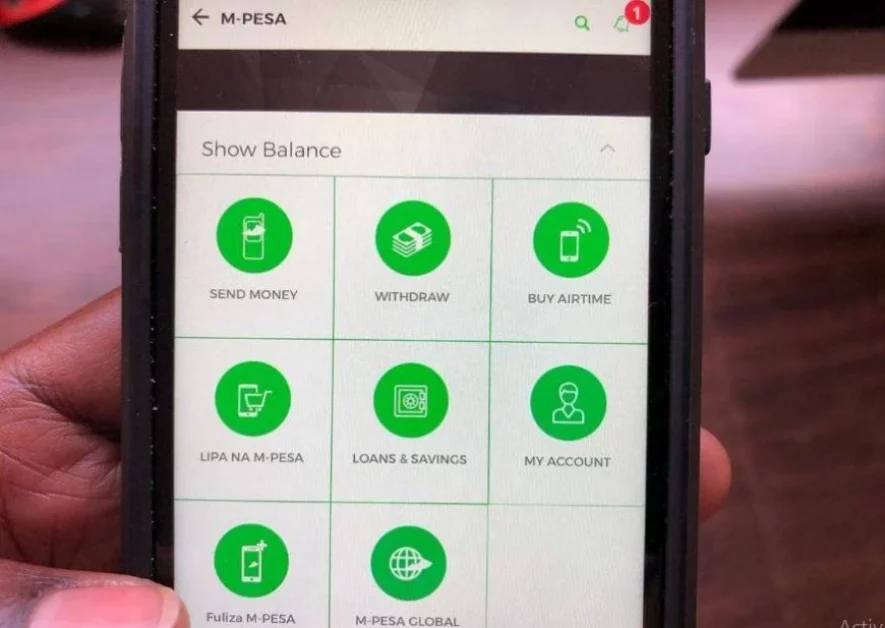

7.4 million Kenyans borrowed from Fuliza between April and the end of September marking the highest number of users.

According to new data from Safaricom, the number of customers rose by 14.2 per cent from 6.4 million persons at the same time last year.

The overdraft loan disbursements grew by 30.1 percent across the six months to Ksh 315.6 billion.

Fuliza currently loans out Ksh 1.7 billion from a low daily average of 1.3 billion.

The overdraft facility has continued to complement Safaricom’s other lending value products including M-shwari and KCB M-pesa.

The value of disbursements on KCB M-pesa has declined by 5.5 percent to 21.7 billion in the six months while M-shwari was flat at 43.4 billion.

Read also:Bitcoin Falls Under $17,000 for the First Time Since 2020

Disbursements from Fuliza are projected to grow even further following a reduction in the pricing overdraft.

Safaricom alongside KCB and NCBA, who co-own Fuliza is working on a program that will see up to four million Kenyans cleared to access loans on the platform.

Subscribe to our youtube channel at Switch TV.

This follows a directive by the president of Kenya William Ruto who encouraged the credit reference bureau to remove Kenyans from the blacklist to enable them to borrow.

Fuliza has been able to raise the telco giant Safaricom’s profits in the previous financial years since it started.

This comes as the treasury has already published regulations that will govern the Ksh 50 billion hustler fund under the public finance management Act.