The largest East African Telecommunication network firm, Safaricom has slashed back the cost of M-pesa pay bill charges by half to foster competition in the mobile money transaction business.

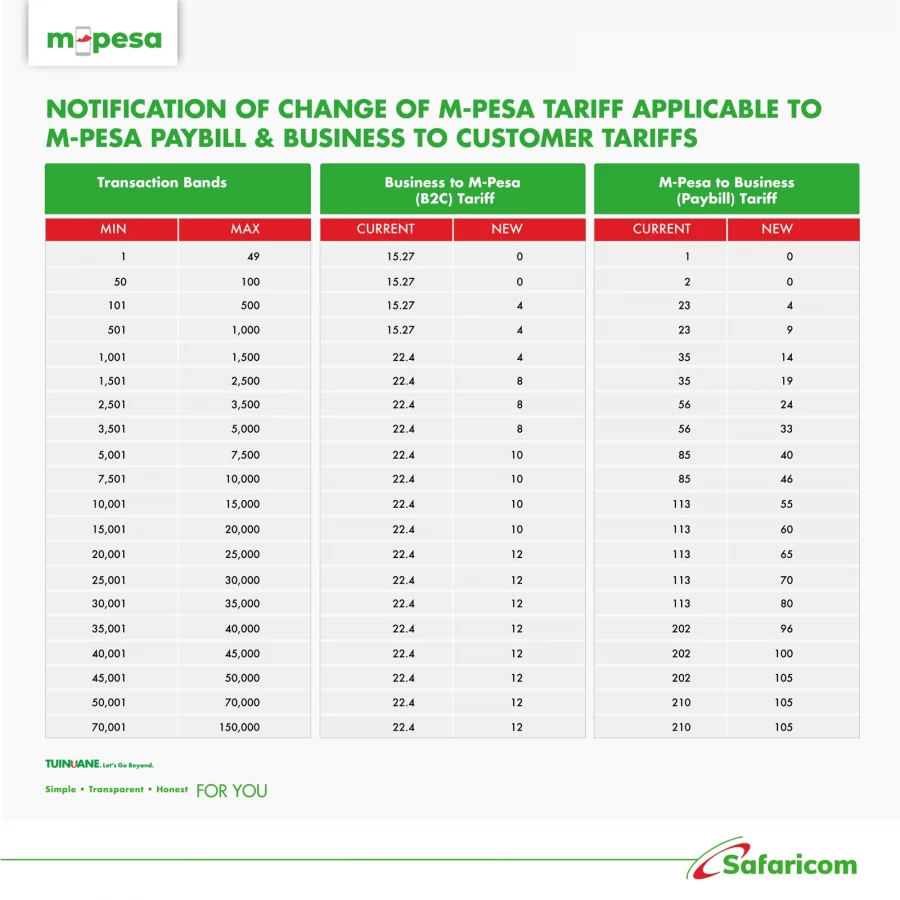

Safaricom customers paying between $0.81 (Kshs.99.68) and $4.05 (Kshs.498.39) are now charged $0.032 (Kshs.3.94) down from $0.19 (Kshs.23.38) in new tariffs applicable as of January 1, 2023.

Transactions below $1 has been zero rated, as part of the new charges between customers and businesses amid increased demand for mobile payment services.

Businesses sending money to customers will be charged $0.041(Kshs.5.05) for payments between $0.81(Kshs. 99.68) and $12.16(Kshs.1,496.41).

Payments of $4 to $8.10 will incur upto $0.073 from the previous $0.19, while that between $405(Ksh. and $1,215 will cost $0.85(Ksh.104.60) down from $1.70(Ksh.209.20).

In a statement Safaricom plc noted “In the new changes businesses to Mpesa charges have been reduced by 41% average, while Mpesa to Paybill charges have been reduced by average of 47%. The paybill tariffs are also applicable to customers sending money to the bank.

Central Bank of Kenya has announced reintroduction of charges between mobile money wallets and bank accounts after agreement reached by the lenders and mobile money payment firms.

Also Read: Investment Opportunities to Look out for in 2023

“The reduced M-pesa to bank accounts will apply to other Mpesa pay bill payments used by customers for other utilities like Electricity, Hospital bills, Schools and Government payments, to ensure affordability ” Safaricom noted in a statement released earlier last week.

The CBK waived the charges in March 2020 as part of measures put in place by the government to contain Covid-19.

The restoration of the charges will help improve the earnings of the lenders who record income from the transactions as part of non-funded income, as well as mobile network operators deriving significant amount of their income from mobile transactions.