By

Cynthia Kenyani

The latest prices will unleash inflationary pressure on

the cost of living as manufacturers of goods, transporters and service

providers pass the increased cost of fuel to the consumers.

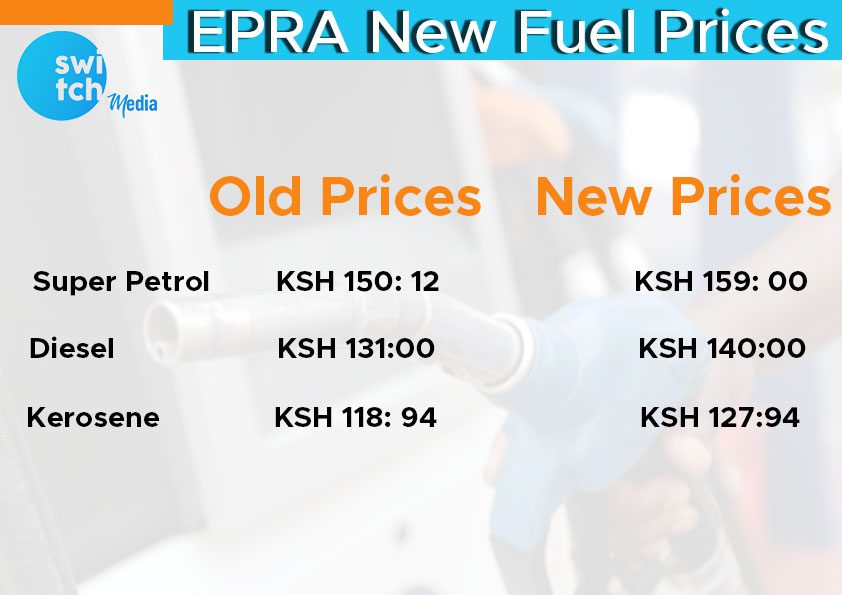

The Energy and Petroleum Regulatory Authority (EPRA) is

set to raise the cost of super, diesel and kerosene by Ksh 9 effective Wednesday

midnight.

Further increase in fuel prices by EPRA is attributed to

the increase in the landed cost of fuel imports in the previous month.

The upward revision in the cost of all the three fuel

products sends the cost of super petrol to Ksh 159.12 per litre with diesel and

kerosene costing Ksh 140 and Ksh 127.94 respectively in Nairobi.

Petroleum prices have set the stage for further increases

in the cost of living at times inflation has hit a 27-month high.

Kenya’s economy is diesel driven and this means that

manufacturers, farmers and service providers will pass the increased fuel cost

to consumers which will further hit households and businesses.

Fuel subsidy is set to cover Ksh 25.56 for super

petrol consumers, Ksh 48.19 for diesel and Ksh 42.43 for kerosene.

The latest prices will unleash inflationary pressure on

the cost of living as manufacturers of goods, transporters and service

providers pass the increased cost of fuel to the consumers.

The cost-of-living measure rose to 7.1% in May from 6.5%

the prior month, marking the highest jump in inflation since February 2020 when

it stood at 7.2%.

This jump comes at the back of a spike in the global cost

of crude with the average landed cost of the commodity that the regulator uses

to set the local prices crossing the $ 100 per barrel mark for the first time.

According to EPRA, the average cost of crude that was

used to set the new prices was Ksh 13,147.70 from Ksh 10,878.40.

The rate of inflation now threatens to break the

government’s upper limit of 7.5% when KNBS publishes the CPI index again on

June 30.

This trend of

higher fuel and food prices forced the CBK and Monetary Policy Committee’s

(MPC) hand in raise benchmark lending rates by 50 basis points to 7.5% at the

end of last month as an inflation containment measure.