The International Monetary Fund (IMF) has offered the Sub-Saharan countries strategies to implement tax reforms without backlash from citizens.

Part of the recommendations after issuing the loans offered to Sub-Saharan countries is better fiscal policies in the country. This ensures that those countries are not entirely dependent on the IMF for funds. The fiscal changes have however been received harshly by the residents in these countries such as Kenya.

The IMF emphasised that for the new policies to be sustainable, have to be accepted by the citizens in the countries. They listed the recommendations in the report titled Resilient Strategies and Credible Anchors in Turbulent Waters.

Bretton Woods Institution advised the countries to gradually implement the new taxes. This way, according to them will not seem like a sudden load on the citizens and would allow them to adapt to the policies faster.

These recommendations from the IMF come after Kenya has been experiencing increased taxes on a daily basis. This trend has caused an uproar among the citizens including protests throughout the country. The new taxes facing backlash include the 16 per cent VAT introduced on fuel from 8 per cent.

In addition to that, the government is planning on introducing an additional 2.75 per cent deduction for the National Health Insurance Fund. The new taxes have consequently led to an increased cost of living within the country.

“The issue of public acceptability should be at the centre of policy design for instance, by properly sequencing the reform process or conceiving compensatory measures,” the report read.

IMF Recommendations

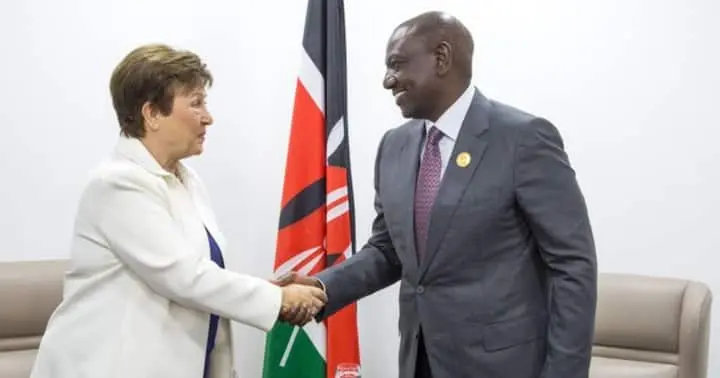

Another suggestion by the IMF was the Presidents in these countries including Ruto, should carry out communication campaigns. These campaigns would enlighten the public about the new fiscal policies that are being introduced and allow for easier acceptance from them.

Within the campaigns, the government could ensure the citizens are aware of the benefits they would receive from the reforms. In addition to that, the consequences of not adopting the new policies.

If the government can convince the public of the need for the new policies and the benefits, then they are more likely to agree to it. In addition to that, they ought to assure the citizens that the money will be used efficiently and in a fair and transparent manner.

According to them, enhanced revenue collection has been possible in Rwanda because of these recommendations. Bolstering tax administration management human resources and digital tax systems enabled citizens to easily agree with the fiscal changes.

Read Also: Dear Kenyans, Here is why you Might Still be Taxed More

Kenyan Citizens are however not inclined to agree to the new taxes due to the current cost of living. More people are facing unemployment, with companies downsizing and letting go of many citizens. In addition to that, taxes have been introduced and they are affecting even the smallest business not giving room for growth of these enterprises. Furthermore, citizens are unable to create start-ups for fear of heavy taxation that may run them bankrupt.

With the recommendations from the IMF, the government may slow down the rate of new fiscal policies in the country. In addition to that, the government may assure Kenyans of proper spending of the revenue collection and consequently reduce the rate of backlash from new taxes.

Subscribe to Switch TV