Kenya’s banking sector has demonstrated remarkable resilience in the face of challenging economic conditions characterized by inflation, prolonged drought, currency depreciation, geopolitical pressure, and election-related uncertainties.

Despite the turbulence witnessed in 2022, banks pumped a substantial amount of money into the government through the Kenya Revenue Authority (KRA), setting a new record.

The year 2022 saw the banking sector’s total tax contribution to the government soar to Sh181.27 billion, the highest amount collected since 2019.

A significant driver of this increase was the Corporate Tax (CT), which surged from Sh49.8 billion in 2021 to Sh87.71 billion in 2022, marking a substantial 77.26% growth.

Furthermore, the withholding tax collected by the banking sector reached Sh37.31 billion during the same period, with an additional contribution of Sh37.23 billion from Pay As You Earn (PAYE).

The report by PwC on Total Tax Contribution of the Kenya Banking Sector in 2022, covering 39 participating banks, revealed that the banking sector’s tax contribution represented 8.93% of all government receipts, a significant increase from 6.82% in 2021.

This highlights the government’s reliance on the banking sector not only to drive economic growth but also to fulfill its tax obligations.

Alice Muriithi, Partner in Tax and Transfer Pricing at PwC Kenya, emphasized the critical role of these tax contributions in funding essential infrastructure, social welfare programs, and overall improvements in citizens’ quality of life.

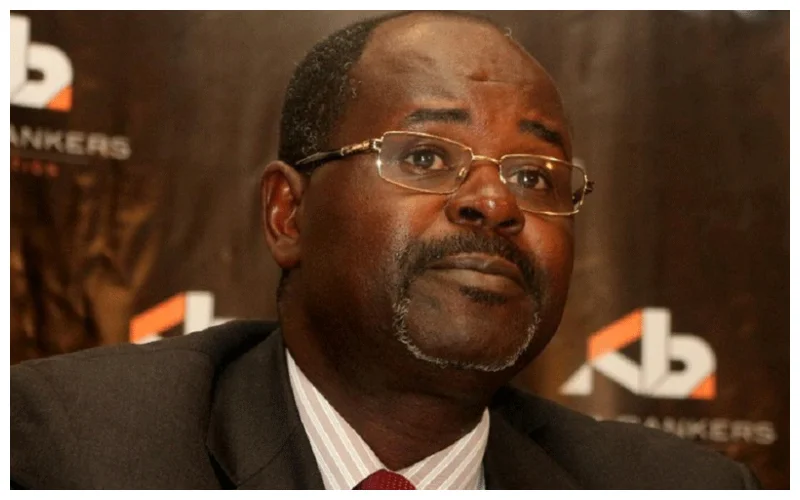

Habil Olaka, the Chief Executive Officer of Kenya Bankers Association, acknowledged the far-reaching impact of the banking sector’s tax contributions and stressed the importance of designing a tax policy framework that fosters sustainable growth.

The report’s historical data since 2018 revealed the fluctuating trends in tax contributions, with the government collecting Sh120.12 billion in 2019, Sh104.83 billion in 2020, Sh129.50 billion in 2021, and Sh99.0 billion in 2018 from banks.

Read Also: Kenya’s Banking Industry Creates Job Opportunities

Notably, in 2020, the banking sector’s total tax contribution declined by 16% due to the economic contraction caused by the Covid-19 pandemic’s first year.

This decline was in line with a 31% decrease in bank profitability, increased loan write-offs and provisions, and the government’s issuance of tax reliefs, including reduced tax rates on Corporate Tax, PAYE, and VAT.

However, in 2021, there was a remarkable rebound, with the total tax contribution relative to 2020 increasing by 23.59%.

The resurgence was driven by significant growth in corporate tax, excise duty collections, and withholding tax – a reflection of the economic recovery following the reopening of all sectors and improved vaccine access.

In 2022, the banking sector’s tax contribution continued its upward trajectory, fueled by a 60.13% increase in Excise Duty, primarily attributed to higher fees and commissions.

Despite the challenges faced, Kenya’s banking sector’s consistent and substantial tax contributions reflect its resilience and commitment to supporting the nation’s economic growth and development.

Subscribe to our YouTube channel Switch TV

As the sector continues to play a pivotal role in the country’s progress, policymakers are urged to design tax policies that foster sustainable growth and stability.