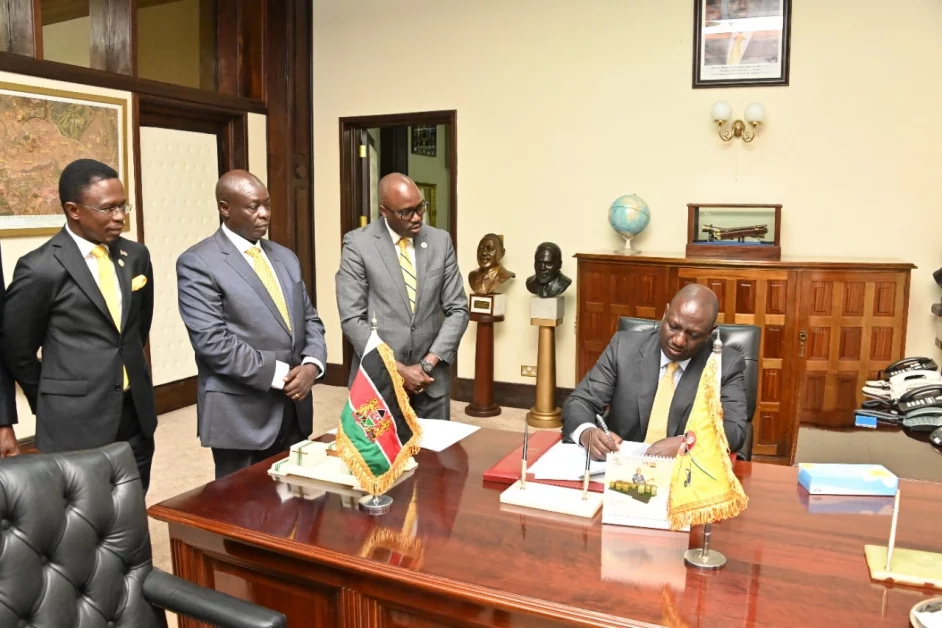

President William Ruto has declined to sign the Finance Bill, 2024, presented to him on Wednesday, June 26.

The bill, which has unleashed unprecedented chaos and mayhem across Kenya due to its burdensome tax proposals, compelling the Head of State to reconsider approval, likely in the interest of national security.

An anonymous source in State House leaked this ahead of President Ruto’s National Address at 4 PM today. According to the Star, the same sources say the Bill will be sent back to Parliament before they break for recess today. The Head of State has also proposed a raft of amendments to the Bill which the MPs will have to consider.

Read Also: Nothing is Cast in Stone – Uhuru’s Plea to Ruto on Finance Bill

Parliament may amend the Bill in light of the president’s reservations or pass it a second time without amending it. In returning the bill, the president will point out key areas that need to be altered.

If the MPs amend the bill fully accommodating the President’s reservations, the speaker shall then resubmit it to the president for assent.

Read Also: We Stand With You: Malema’s EFF Releases Statement on Finance Bill Protests

If the House considers the president’s reservations, it may pass it a second time, without amendment, or with amendments that do not fully accommodate his reservations. This must, however, be supported by two-thirds of the members.

With the MPs set to go on recess beginning today until July 23, it means that should the President return the document to Parliament, the speaker may have to recall them.

Read Also: Occupy Parliament: How We Got Here

Some of the tax proposals which had earlier been introduced in the bill include:

- 16 per cent VAT on bread

- Excise duty on vegetable oil

- VAT on the transportation of sugar

- 2.5 per cent Motor Vehicle Tax

- Eco Levy on locally manufactured products

These proposals have since been dropped. The bill passed the committee of the whole house after these amendments were made.

The committee of the whole house format allows for detailed examination of each clause, ensuring thorough consideration before the bill progresses to subsequent stages of legislative review.