The Energy and Petroleum Regulatory Authority (EPRA) has announced a significant reduction in fuel prices during its latest monthly review.

Effective midnight for the next 30 days, super petrol, diesel, and kerosene will now retail at Ksh 207, Ksh 196.47, and Ksh 194.23 per litre, respectively, in Nairobi.

This adjustment is poised to bring relief to motorists and households grappling with the challenges of a high cost of living.

Read Also: Kajiado Motorists Flock Tanzania for Cheaper Fuel

EPRA’s statement on Sunday underscored that these prices include the 16% Value Added Tax (VAT), aligning with the provisions of the Finance Act 2023, the Tax Laws (Amendment) Act 2020, and the revised rates for excise duty adjusted for inflation, as per Legal Notice No. 194 of 2020.

On Monday, January 15, 2024, EPRA announced a revision in pump prices, reducing the cost by Ksh 5 per litre for petrol and diesel and Ksh 4.82 per litre for kerosene.

This adjustment brought the prices in Nairobi down to Ksh 207.36, KSh 196.47, and Ksh 194.23 per litre, respectively.

In accordance with Section 101(y) of the Petroleum Act 2019 and Legal Notice No.192 of 2022, @EPRA_Ke has calculated the maximum retail prices of petroleum products, which will be in force from 𝟏𝟓𝐭𝐡 𝐉𝐚𝐧𝐮𝐚𝐫𝐲 𝟐𝟎𝟐𝟒 to 𝟏𝟒𝐭𝐡 𝐅𝐞𝐛𝐫𝐮𝐚𝐫𝐲 𝟐𝟎𝟐𝟒.^DC pic.twitter.com/wvmFnuvKhp

— Energy and Petroleum Regulatory Authority (@EPRA_Ke) January 14, 2024

Despite the apparent relief, Kenyans expressed scepticism about the significance of the new pump prices, especially in the context of the existing government-to-government (G2G) oil import deal and the substantial drop in global fuel prices.

The impact of this price revision extends beyond the capital city to other regions. In Nakuru, petrol will be available at KSh 206.35, diesel at Ksh 195.88, and kerosene at KSh 193.66.

Eldoret residents can expect petrol at Ksh 207.12, diesel at Ksh 196.65, and kerosene at Ksh 194.43. In Mombasa, super petrol will retail at Ksh 204.3, diesel at Ksh 193.41, and kerosene at Ksh 191.05.

The revised rates are anticipated to positively impact household budgets and transportation costs, contributing to a slightly more affordable living experience for Kenyans.

Good news as fuel prices are down by Sh5 per litre.

— Moe (@moneyacademyKE) January 15, 2024

New prices:

Petrol —Sh207

Diesel —Sh196

Kerosene —Sh194

EPRA’s Pump Price Review

The EPRA’s review covered the period from January 15 to February 14, 2024, reflecting a reduction in pump prices for petrol and diesel by Ksh 5 Kerosene, commonly used for cooking among low-income households, experienced a drop of Ksh 4.82, bringing its retail price to Ksh 194.23 per litre.

EPRA attributed these changes to a decrease in the landing cost of petroleum products between November and December 2023.

Kenyans’ Concerns and Reactions

While the reduction in fuel prices was anticipated to bring relief to consumers, many Kenyans questioned its actual impact. Some argued that the decrease was not substantial enough to make a significant difference in their daily expenses.

Others pointed out that global fuel prices had been declining at a faster rate than the local adjustment.

On social media, users expressed their views, with some suggesting that the G2G oil import deal had failed, calling for a return to the Open Tender System (OTS). Concerns were also raised about the overall management of fuel prices, questioning the effectiveness of measures in place.

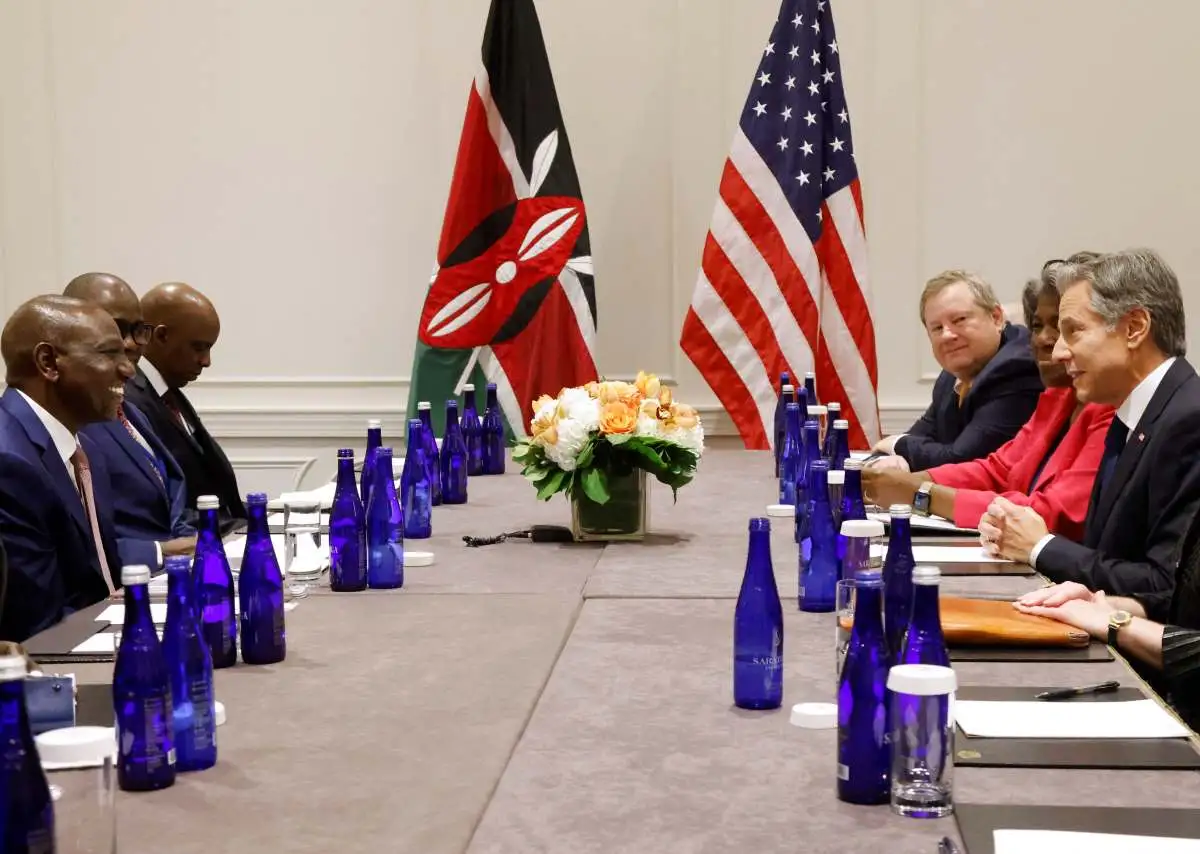

Government-to-Government (G2G) Oil Import Deal

The backdrop of this discussion involves Kenya’s G2G oil import credit deal with Gulf firms, including Saudi Aramco, Emirates, and Abu Dhabi oil companies. This agreement aims to import fuel on credit for six months, providing a buffer for the weakening Kenyan shilling.

Despite this initiative, questions persist about its efficacy and the overall impact on the local economy.

Global Fuel Prices and Economic Dynamics

Amidst these local developments, global fuel prices have been experiencing a decline, leading some to argue that the local reduction should have been more significant.

Additionally, concerns were raised about the impact of the fluctuating exchange rates, with the expectation that a reversal in the shilling’s fortunes against the dollar could lead to a more substantial drop in pump prices.

As Kenyans question the effectiveness of the G2G oil import deal and evaluate the significance of reduced fuel prices, the broader economic dynamics, both globally and locally, continue to shape the discourse around the cost of living and consumer expenses.