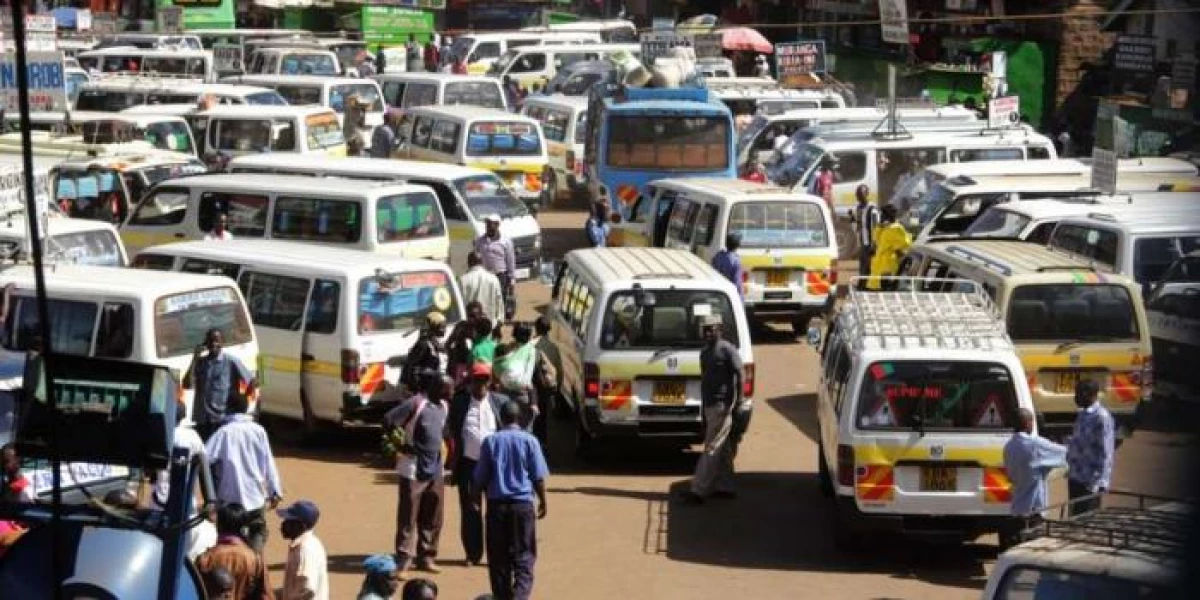

Kenya’s economy has faced a significant slowdown recently, primarily due to escalating fuel prices and the depreciation of the Kenyan Shilling against the US dollar. The latest data from the September 2023 Stanbic Bank Kenya Purchasing Managers Index (PMI) sheds light on the situation.

The report revealed that Kenyan businesses have reported a decrease in new orders and reduced sales, leading to cutbacks in production, employment, and inventory levels. The PMI, which measures the economic activity, dropped from 50.6 to 47.8, indicating a significant decline in Kenya’s economic performance.

To mitigate their increasing costs, companies have significantly raised selling prices, which, in turn, impacts consumers.

An economist at Standard Bank, Christopher Legilisho, attributes this economic slowdown to the recent surge in fuel prices, averaging an increase of Ksh23.80, and tax hikes, which have adversely affected consumer demand.

Both the output and new order volumes have declined, continuing a concerning trend observed over the past eight months. Survey participants attribute these contractions to rapid price increases, which create cost pressures and reduce customer demand.

Read Also: Economy Showdown for Kenyans as Bank Dollar Rate Shoots to Ksh130

Despite these challenges, Kenyan businesses remain cautiously optimistic about future prospects. Approximately 19% of survey respondents anticipate output growth in the coming year, often tied to expansion plans.

Manufacturing firms appear the most optimistic about the economic outlook, while wholesale and retail sectors exhibit lower confidence. Inflationary pressures persist, with input and output prices remaining elevated. A substantial 42% of surveyed firms have reported higher costs, frequently due to the deteriorating exchange rate.

Subscribe to our YouTube channel: Switch TV

Christopher Legilisho’s outlook remains cautious yet hopeful, stating, “The situation in September paints a concerning picture, and there may be further near-term exchange rate depreciation despite recent reforms. Nevertheless, we anticipate resilient GDP growth of 5.5-5.8%, primarily driven by agriculture.”