The Kenyan shilling breached the 150-unit mark against the US dollar on Monday, marking a sustained period of depreciation that has narrowed the gap between official and retail dollar rates. Since the year began, the Kenyan shilling has depreciated by 17.7%, a substantial increase compared to the 8.3% decline observed throughout 2022.

The Central Bank of Kenya (CBK) published an indicative rate on Monday morning, reporting a buying price of Ksh149.84 and a selling rate of Ksh150.04, averaging at Ksh149.94. In the afternoon, the spot or average trading rate reached Ksh150.03.

In the banking sector, a survey of 12 commercial lenders, including all nine top banks, revealed a range of selling rates between Ksh154.95 and Ksh157, while buying rates varied from Ksh141 to Ksh149.95. Meanwhile, Forex bureaus quoted dollar selling prices from Ksh156.50 to Ksh157, with buying rates between Ksh152 and Ksh153 according to the Business Daily.

Banks have been consistently selling the US dollar above the Ksh150 level since late August. Some analysts suggest that the market is encountering resistance around the Ksh156 mark, potentially indicating a stabilization of the currency’s value after months of depreciation.

Read Also: Kenyan Shilling Predicted to Trade at 150 Per US Dollar By Year’s End

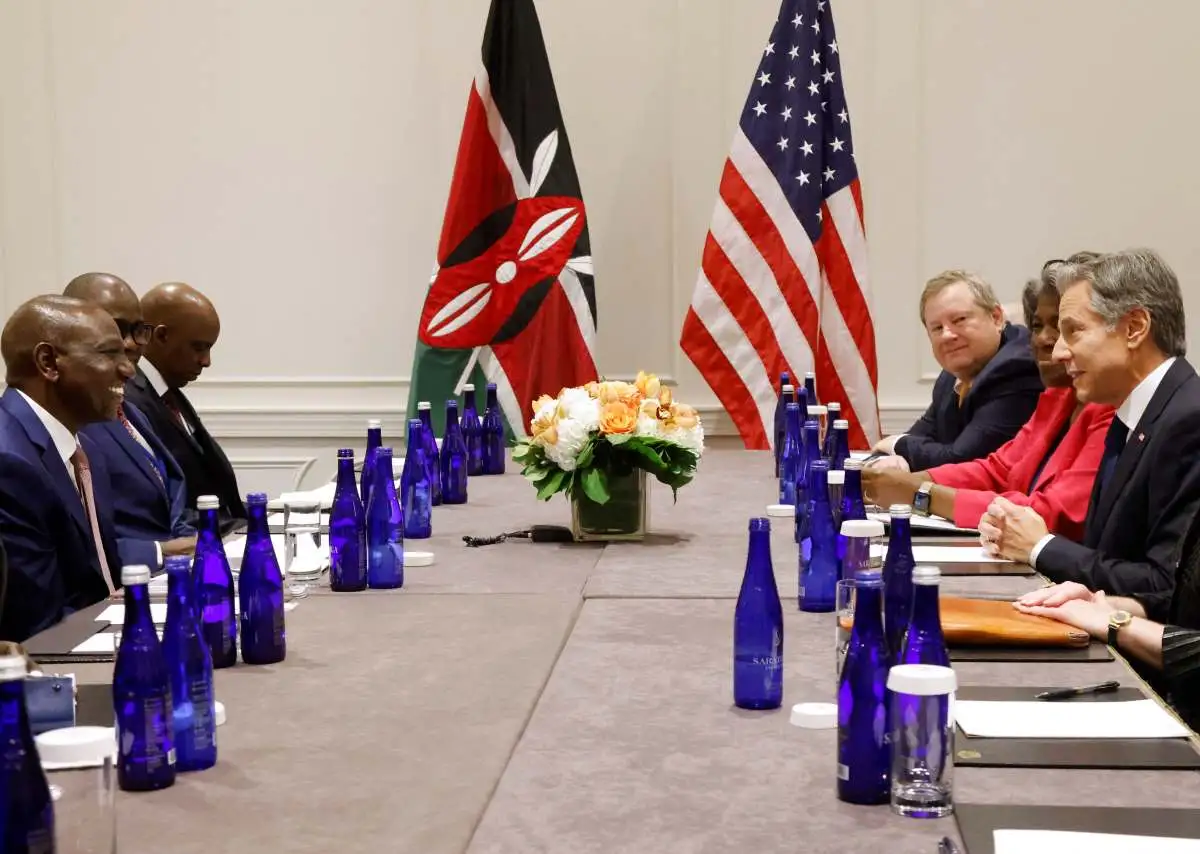

Kenyan Treasury Cabinet Secretary Njuguna Ndung’u, addressing the National Assembly on September 27, described the recent shilling devaluation as an essential “adjustment” rather than a free fall, attributing it to historical policy errors in currency management. He noted that Kenya had maintained relative currency stability over the last five to seven years, leading to a misalignment with the changing economic landscape.

In contrast to neighbouring currencies, the Kenyan shilling’s depreciation against the US dollar this year is particularly significant. While the Ugandan shilling has seen a marginal 0.96% decline and the Tanzanian unit has experienced a 6.8% decrease, the Rwandan Franc has appreciated by 14% against the US dollar since the beginning of the year.

Kenya’s inflation rate unexpectedly rose to 6.8% in September 2023, the first increase since May 2023. This increase brings it within the central bank’s preferred range of 2.5% to 7.5%. The food index, which constitutes a significant portion of the inflation basket, rose by 7.9% in September, up from the 7.5% recorded in August.

Subscribe to Switch TV for more exciting content

Additionally, prices increased for other consumer price index (CPI) items, including transportation (16.6% vs. 13.1%), alcoholic beverages and tobacco (10.9% vs. 10.1%), housing and utilities (8.9% vs. 7.5%), recreation and culture (5.9% vs. 5.6%), and restaurants and hotels (5.1% vs. 4.7%). On a monthly basis, consumer prices rose by 1%, following a 0.1% decrease in the previous month.