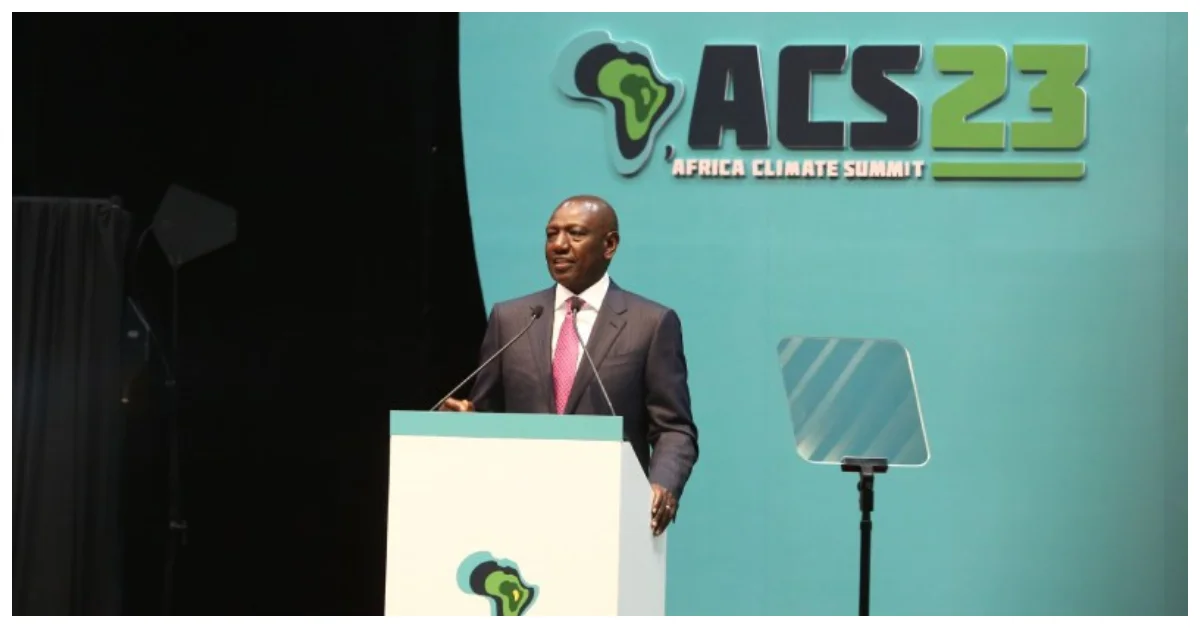

President William Ruto and Sudanese-British billionaire businessman Mohammed Ibrahim have raised concerns about the business practices of credit rating agencies during the Africa Climate Summit (ACS).

President Ruto strongly criticized these agencies, accusing them of negatively impacting African economies. He argued that credit rating agencies frequently classify African economies as “junk,” making it difficult for the continent to attract investments.

According to Ruto, potential investors are eager to engage with Africa, but the actions of these rating agencies deter them. He also noted that pension funds and insurance companies are hesitant to invest in Africa due to perceived risks associated with these economies.

Ibrahim questioned the operational model of credit rating agencies, highlighting a conflict of interest in their dual roles as auditors and consultants. He contended that grading nations and then providing them with advice on how to improve their ratings creates a problematic situation that can lead to legal consequences.

“How do you expect the continent to attract investments if the rating agencies keep on classifying most of the economies as junk, the investors out there want to do business with Africa, but the rating agencies make it difficult,” said Ibrahim.

President Ruto further criticized the algorithms used by rating agencies, asserting that they lack a foundation in empirical science. He called for more transparent discussions about their data and findings.

Read Also: Issuer Default Rating Changes Kenya’s Outlook from Stable to Negative

Ibrahim also scrutinized the governance of the World Bank and the International Monetary Fund (IMF) during the ACS. He advocated for greater independence for the World Bank by introducing independent directors.

Moody’s Credit Rating Agency faced criticism from the Africa Peer Review Mechanism (APRM) in August for its comments on Kenya’s planned buyback of its Eurobond debt. APRM considered Moody’s comments premature and cautioned against issuing pessimistic and negative assessments without conducting sufficient research.

In response to these concerns, the African Union institution is pushing for the Africa Network of National Regulators of Rating Agencies to implement regulatory measures to ensure the proper conduct of credit rating businesses.

Subscribe to Switch TV for more content.

Kenya has faced not only Moody’s pessimistic outlook but also downgrades from Fitch and S&P Global Ratings. Fitch Ratings revised Kenya’s Outlook to Negative, citing external financing constraints, high funding requirements, weakening international reserves, rising financing costs, and fiscal uncertainty, including the execution risks associated with announced tax hikes amid social unrest.