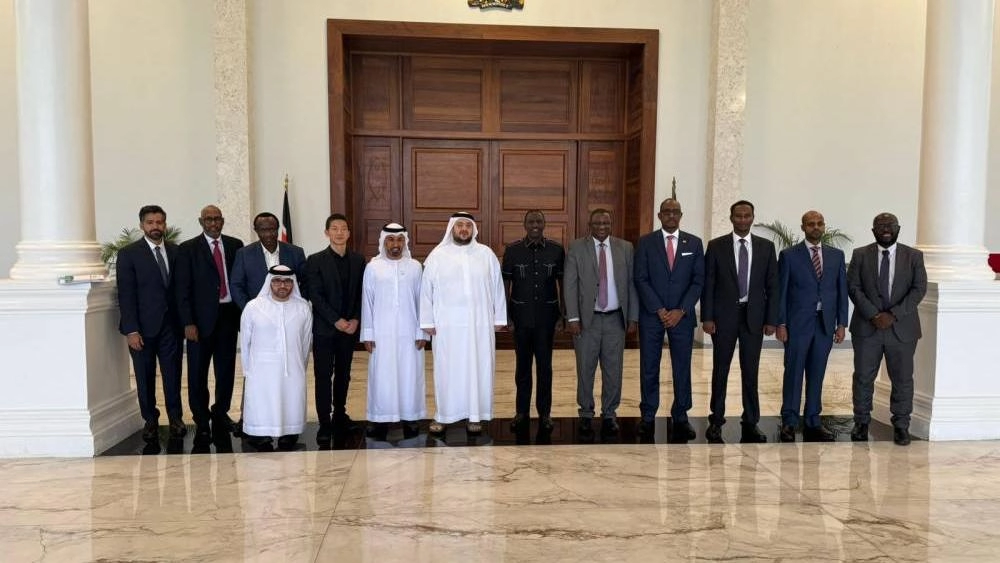

Safaricom, the leading telecommunications company in Kenya, has gained approval from the central bank to significantly raise the daily transaction limits on its mobile money platform, M-Pesa.

This move, which allows transactions up to Sh500,000 per day, marks a strategic step to enhance its competitiveness in the digital payments sector, where commercial banks have also been actively participating.

In addition to the higher transaction limits, Safaricom has expanded the maximum amount individuals and businesses can hold in their M-Pesa wallets to Sh500,000, reflecting the evolution of mobile money from person-to-person payments to a tool for e-commerce.

This change follows a previous limit of Sh300,000, which was imposed due to concerns about money laundering risks associated with mobile money.

According to Business Daily, the Central Bank of Kenya (CBK) had been cautious about raising these limits in the past due to concerns about financial safeguards and anti-money laundering efforts.

However, as these concerns diminish, this marks the second instance in three years where CBK has permitted Safaricom to increase account and transaction limits.

Safaricom’s CEO, Peter Ndegwa, expressed appreciation for the central bank’s guidance in strengthening M-Pesa’s compliance with regulations. He highlighted that the elevated transaction limits would benefit customers, particularly small businesses, as the shift toward cashless transactions gains momentum.

Read Also: Safaricom to Set New Prices for Services in Response to Finance Act 2023

This decision also positions Safaricom to better compete with financial institutions, particularly in the realm of financial technology and payment solutions. Mobile money transactions have become a significant contributor to Kenya’s economy, amounting to over half of the gross domestic product (GDP), with a notable surge during the Covid-19 pandemic.

It’s important to note that while the daily transaction limit has been raised, the per-transaction limit of Sh150,000 remains unchanged. Customers can make multiple transactions up to the daily limit of Sh500,000.

Safaricom’s success with its mobile money platform is evident, as more than 606,000 businesses utilized its Lipa Na M-Pesa service, leading to a total of Sh1.625 trillion in transactions over the last fiscal year ending in March 2023.

Kenya’s pioneering role in mobile banking through innovations like M-Pesa has garnered international recognition. However, this surge in mobile money transactions hasn’t gone unnoticed by the government, as the Treasury introduced and later increased excise duties on financial transactions to generate revenue.

Subscribe to our YouTube channel Switch TV

This shift towards higher transaction limits underscores Kenya’s progress toward a cashless economy, accelerated by the pandemic and supported by technological advancements in the financial sector.