In an official statement released on Tuesday, August 15th the Kenya Revenue Authority has explained how the housing levy will be deducted from employees.

According to the directive, the levy will be deducted from employees’ gross monthly income, inclusive of basic salary and regular cash allowances such as housing, travel, and car allowances. However, non-cash benefits and irregular payments like bonuses, leave allowances, and pension will not be subject to the levy.

“Gross monthly salary constitutes basic salary and other regular cash allowances. This includes housing, travel or commuter, car allowances and such regular payments and would exclude those that are non-cash as well as those not paid regularly such as leave allowance, bonus, gratuity, pension, gratuity, pension, severance pay or any other terminal dues or benefits,’’ read part of the statement.

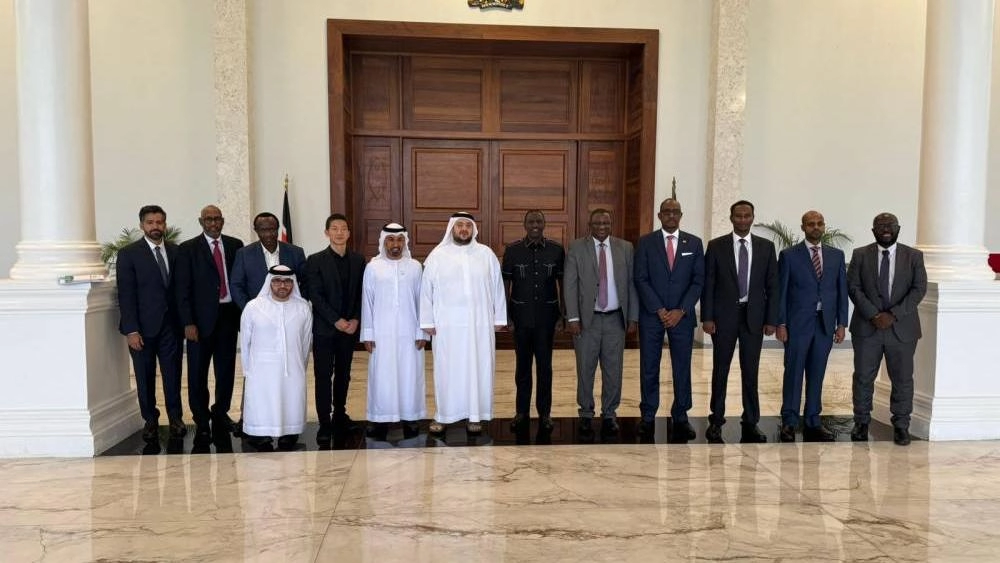

The Kenyan government applied the housing tax starting from July 1, following the Court of Appeal’s decision to lift the suspension on the Finance Act 2023. The Kenya Revenue Authority (KRA) has been designated as the entity responsible for collecting this levy.

A recent internal communication from KRA instructed its officials to adhere to the specific dates outlined in the Finance Act 2023 when implementing the tax modifications. These changes, as per the directive, will be enforced as stipulated in Section 1 of the Act.

The new housing levy entails a 1.5% deduction from employees’ gross monthly income, while employers are mandated to match this contribution. Nevertheless, the combined sum contributed by an employee and their employer must not exceed Ksh5,000.

Read Also: KRA Implements Affordable Housing Levy Contributions

The Finance Act 2023 received presidential approval on June 26, 2023, bringing substantial changes to various tax regulations. The majority of these amendments took effect on July 1, 2023, coinciding with the government’s fiscal year, with a few adjustments expected to be implemented later, on September 1, 2023, and January 1, 2024.

The legitimacy of the Act faced legal challenges, resulting in a temporary suspension. However, on July 28th 2023, the Court of Appeal ruled to lift the suspension, allowing the Act to be enforced. This decision has since been contested through an appeal to the Supreme Court.

During the legislative process, the housing levy proposal sparked controversy and a heated debate between members of the Kenyan Kwanza parliamentary faction and their counterparts from the opposition coalition. The proposal managed to garner support from 184 members of the national assembly, while 72 opposition members voted against it.

Subscribe to Switch TV

The implementation of the housing levy marks a significant step towards financing Kenya’s affordable housing initiative, despite the ongoing debates and legal challenges surrounding its introduction.