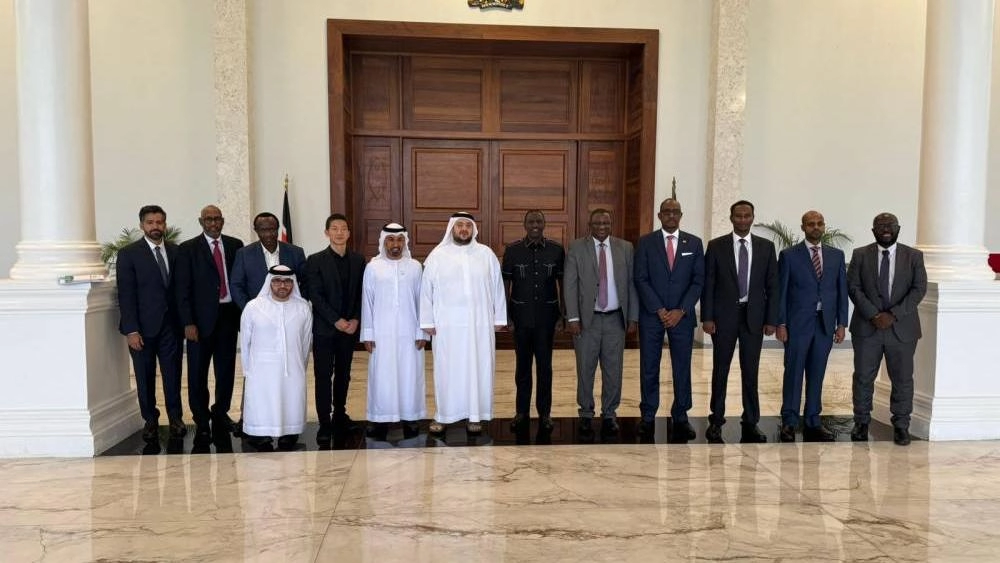

Pesapal, Kenya’s leading Payment Provider, has partnered with Sokohela, a digital credit provider licensed by the Central Bank of Kenya (CBK), to launch a new credit product for small and medium-sized enterprises (SMEs) in Kenya.

The loan product will offer fast and flexible financing solutions for SMEs that face challenges in accessing credit from traditional sources

“SMEs are the engine of our economy, but they often face difficulty accessing credit due to high-interest rates, stringent collateral requirements, lengthy procedures, and lack of financial records,” said Pesapal founder Mr. Agosta Liko.

Read Also : Red Cross Launches Women Social Entrepreneurship Institute in Mombasa

”We understand these challenges and have partnered with Sokohela to address them. We’re all about our merchants being confident with their financial decisions and becoming world-class at what they do – regardless of their size,” he added.

Additionally, Mr. Agosta Liko also said that the main aim for Pesapal to design their tools is to ensure entreprenuers achieve their business goals without overextending. This as their finance terms are transparent and easy to understand.

Sokohela’s CEO, Mr. Nickson Onyango, also added that the partnership with Pesapal shows the power of collaboration in driving innovation and growth in Africa’s digital economy.

Mr. Onyango noted that their objective is to reach out to more SMEs and offer them convenient and affordable credit solutions that suit their needs.

Other benefits that the new Pesapal Credit has for SMEs include: flexible repayment terms of up to 12 months, transparency in pricing of the loan, that is, no hidden fees or charges and lastly it is an online application, therefore the management of loans is via the Pesapal Platfrom.

Below are the steps of applying for the platform:

- First sign up on one of the digital payments solutions such as e-commerce, POS or Openfloat for your day-to-day business collections and payouts.

- Credit scoring model will automatically score and offer a maximum loan limit.

- Request your preferred loan amount and choose a repayment plan that suits your needs.

- Receive an instant decision and get the loan amount disbursed to your Pesapal Openfloat account.

- Automatically repay the loan from your Pesapal transactions according to the agreed schedule.

Subscribe to Switch TV for more content