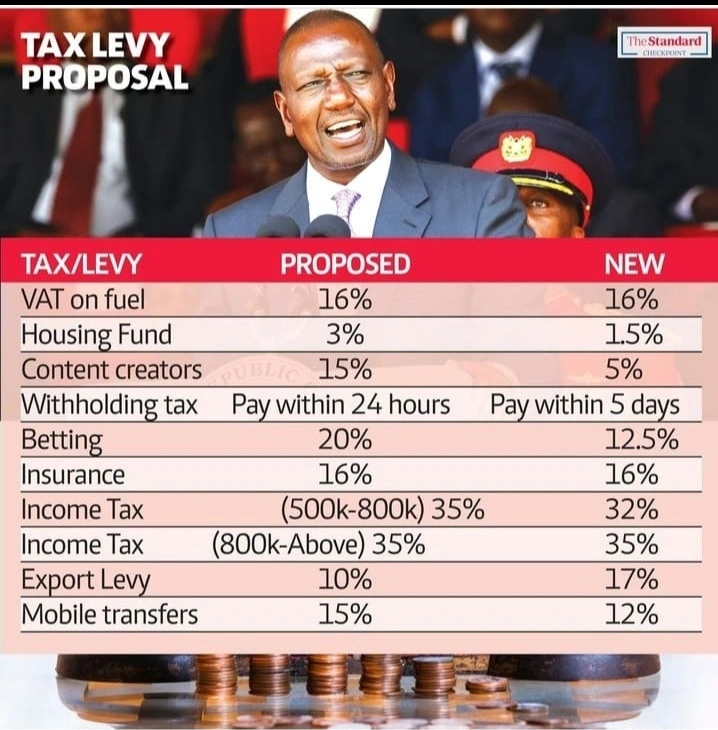

For the Finance Bill 2023, The finance committee unanimously agreed to retain the increased fuel VAT at 16 per cent. Possibilities for taxpayers to still dig into their pockets even after new proposals for the finance bill were created.

Though the people are concerned over the proposed increased VAT on fuel, the finance committee still stands on it. They would miss out on a large amount of revenue if they were to cancel out the VAT or retain it where it is at 8%.

Alongside the amendments, the finance committee agreed to reduce the housing levy from 3% to 1.5%. This controversial housing levy has been reduced to suit the demands of the opposition and the people. However, it doesn’t bring any hope. Before, the 3% levy was capped at Ksh 3,000 but with the new proposal, there is no maximum limit. One will therefore pay 1.5% of their salary regardless of how much it is.

Subscribe to our Youtube channel Switch TV

While discussing, the finance committee agreed to increase the firm’s turnover tax from 500,000 to 1 million and pegged it at a 3% tax.

Heeding the cry of content creators, they have reduced their withholding tax from 15% to 5%. Moreover, locally manufactured phones have been spared excise duty to increase their production.

Regardless of the people complaining about the high cost of living, the finance committee still stands on retaining the 8% VAT on fuel would hurt the government revenue that helps it.

They have reduced this burden on citizens by zero-rating the liquefied petroleum gas and cylinders. This comes after the president promised to reduce the cost of gas cylinders to 300 and later on emphasized that he would reduce the cost of gas cylinders and not the gas itself.

They have also placed the assembly of electric vehicles and buses as well as electric cooking stoves on zero rating. All these are placed at zero-rating to help the citizen and promote clean energy. Aiming for the attainment of clean energy and mitigation of climate change.

Among other amendments is, a reduction in VAT of rental income from 10% to 7.5 per cent. They also reduced the Pay as You Earn tax for people earning more than 500,000 from 35% to 32%. They, however, introduced that those earning from 800,000 would pay a PAYE of 35%.

In addition to all these, the finance committee still stands on monitoring digital assets transactions. Over time, digital assets transactions haven’t been captured in the system leaving them untaxed.

Unless you have some personal grudge against President William Ruto, the changes to the Financial bill 2023 are reasonable and the bill is now supposed to pass without any more alterations pic.twitter.com/yk4nUtSB7C

— S A D A M H U S S E I N (@IbnulHussein) June 13, 2023

With these new proposals, will the finance bill still be controversial or will citizens agree?

Read Also: The Finance Bill 2023: A Closer Look at its Impact Beyond the Housing Fund Debate