The famous Kenya Airways debt has raised concern among potential investors for the estimated equity interest sale. This has become the airline’s biggest obstacle in its pursuit to attract investors.

According to KQ managers, several hunting trips to assess the interest of the company’s stock offer in China, the US and the Middle East have so far not been fruitful. The managers informed Parliament that there are no commitments in spite of them having leads.

“All the potential investors we spoke to agreed that the fundamentals of the company are very strong. Their concern was on debt level and that’s why a good strategy would be reducing the company’s debt to get extra funding into the company,” said KQ CEO Allan Kilavuka.

Read Also:John Ngumi Steps Down from Kenya Airways

The company’s management also revealed its plans of being on the look out for a financial advisor who will be of service in creating an investor letter that will be used as a guide when picking the preferred investors. With the admission of a strategic investor, the government’s exposure to risk and expense is expected to decrease.

The resolution about a financial advisor will be made through the airline’s internal procurement procedure and is expected to be finalized in December.

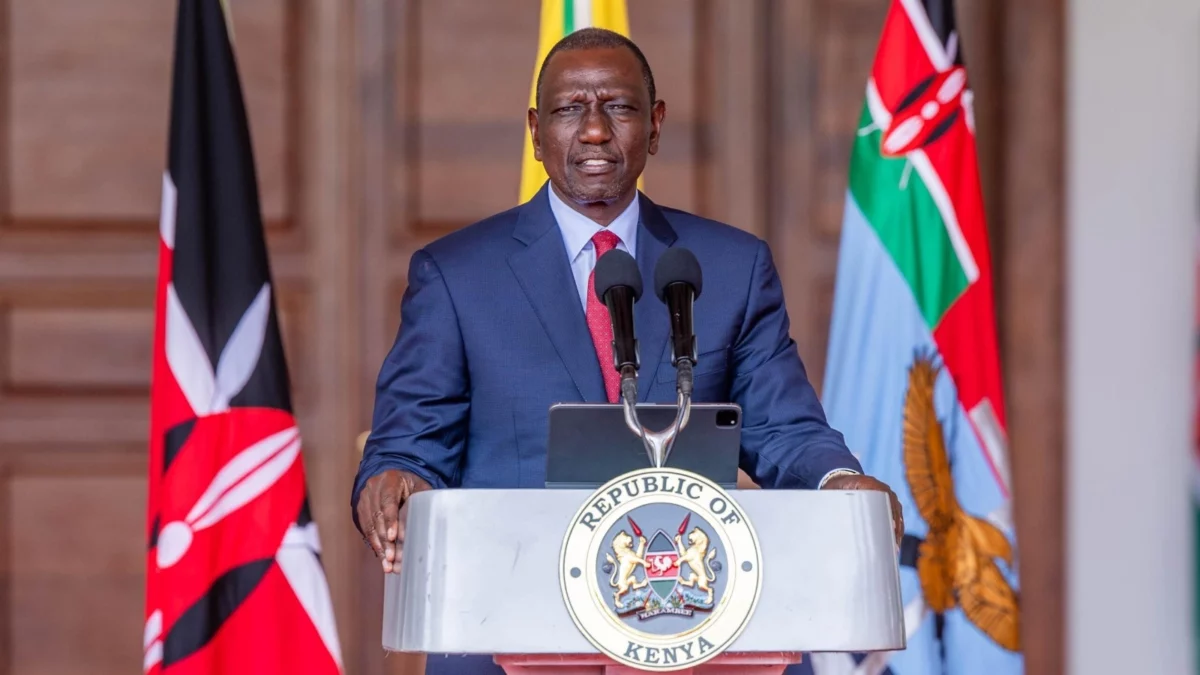

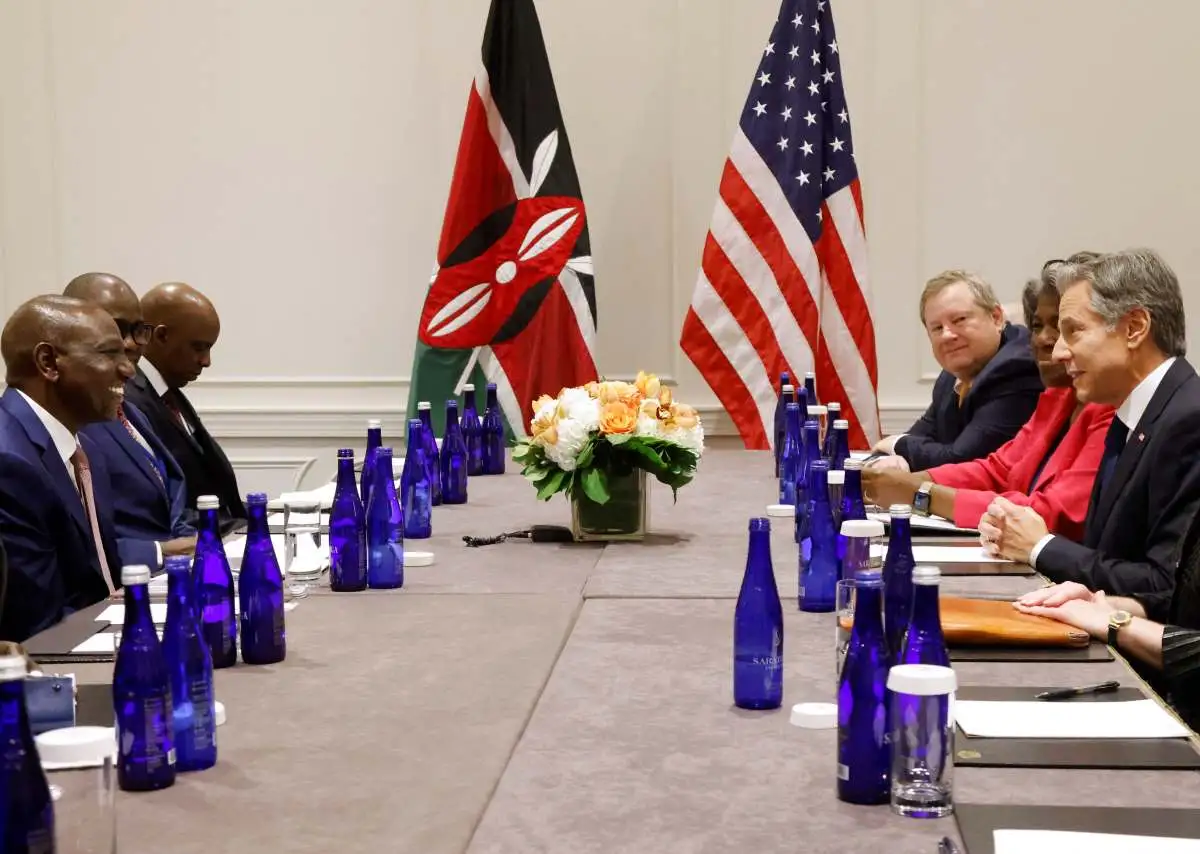

In December last year, President Ruto took a team to Washington with the aim of aiding the already grappling airline return to profitability by pushing to sell a majority interest in KQ. The pursuit by the government to cone across a strategic investor in KQ corresponds with the exchequer pausing its bailouts of the airline in the Financial year beginning July 1.

Subscribe to our Youtube channel Switch TV

As of the end of May, the airline owes creditors Ksh187.74 billion. Ksh61.4 billion was used to purchase six Boeing 787-7 aircraft, one Boeing 777-300 ER aircraft and one Genx engine in 2012. The government took up the guaranteed debt after the airline failed to make payments. Ksh10.1 billion had been cleared at the end of March 2023.