The Kenyan digital content creation industry has experienced tremendous growth in recent years, with creators earning substantial incomes from digital platforms.

YouTube, TikTok and Instagram are some of the social media platforms that have made it possible for digital creators to make an income. The rise in popularity has also led to local companies rushing to secure influencer deals through contracts, creating a lucrative market for talented individuals.

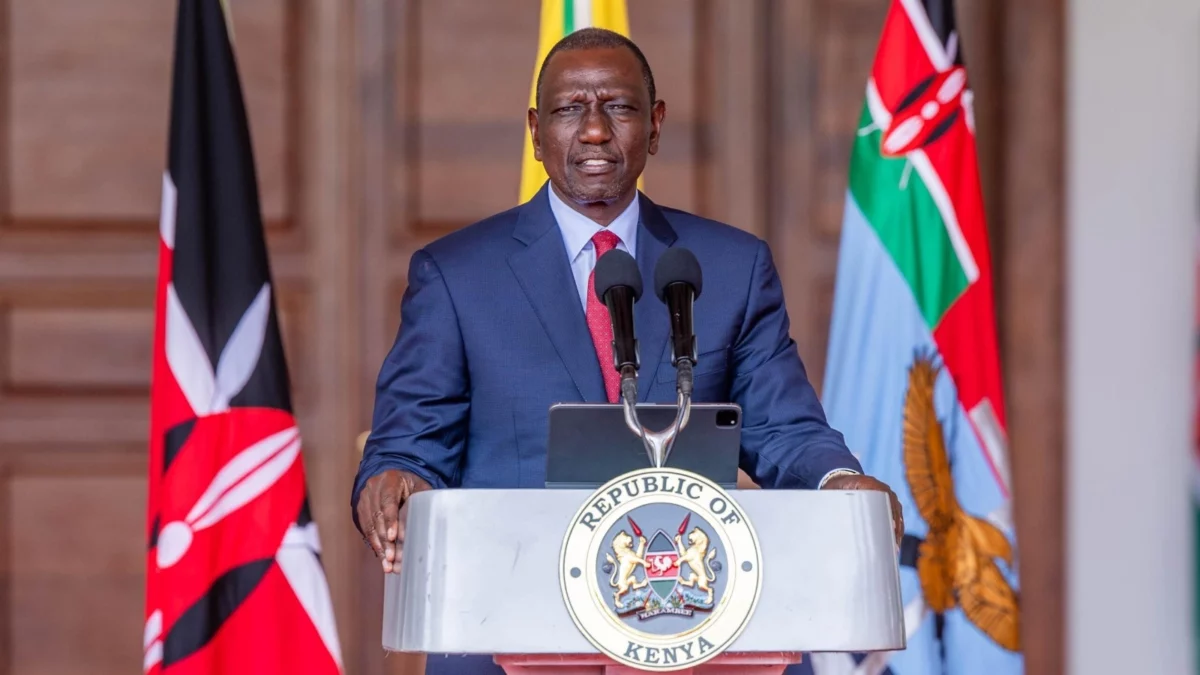

The increasing potential of the online market has made the government take notice and aims to claim a larger share of this thriving industry by proposing several amendments to the Finance Bill 2023, including the taxation of payments made to digital creators.

If approved, the proposed amendments would subject income earned through digital content monetization to a 15 percent withholding tax, significantly higher than the 5 percent rate imposed on professional services.

This move has sparked controversy among content creators, who argue that it is unfair, particularly for young people striving to make a living in an environment where quality jobs are scarce.

Mohammed Assad Alby, a well-known content creator, expressed his discontent with the tax proposal, describing it as “extremely unfair” to young individuals trying to make ends meet.

Alby, whose social media presence includes over 634,000 followers on TikTok, more than 159,000 on Instagram, and 32,000 YouTube subscribers, believes that the tax will discourage job creation and hinder the growth of the industry.

“We have to come up with ways of creatively earning income for ourselves in ways that the older generation would never have thought of only to be slapped with tax. From all the tax changes ours is the craziest,” said Mohammed.

Read Also: Will The Government Maintain its Current Tax Regime in The Next Financial Year?

Significant content creators like Alby and Kevin Maina, a 23-year-old artist with a significant following on TikTok and Instagram, mentioned the hidden costs and challenges involved in content creation.

They emphasized that before earning money from their content, they invest heavily in equipment such as cameras, laptops, editing software, microphones, and lighting. These expenses, coupled with the competitive nature of the industry, make it difficult for creators to succeed.

They argue that higher taxes on their income will limit their capacity to invest in their craft and potentially affect the quality of their work.

Nancy Wotune, a senior advisor at Ichiban Tax and Business Advisory LLP, provides insights into the proposed tax. She explains that the tax is an advance payment on the income of digital content creators, which they would usually be required to pay at a later stage.

Nancy predicts that the creative industry will continue to grow due to the rapid shift from traditional commerce to digital platforms. However, she acknowledges that the higher tax rate of 15 percent, compared to the ordinary 5 percent for professional services, could lead to income tax refunds for content creators after deducting their expenses.

Addressing concerns about tracking earnings across multiple digital platforms, Wotune clarifies that the responsibility to withhold taxes falls on the person making payments to content creators.

KRA expects data on these transactions to be disclosed, enabling them to collect the required taxes. Additionally, there is a proposal to implement an electronic tax invoice system, ensuring traceability of these transactions.

The proposed amendments to the Finance Bill 2023 have ignited a debate about the future of the creative industry in Kenya. Content creators are worried about the potential financial burdens and limitations on their growth, while the government aims to increase its revenue from the advancing digital space.

Subscribe to our Youtube channel Switch TV