Kenya has initiated action to move away from dollar dominance. The president told the African leaders to offer assistance in withdrawing from the US dollar.

This would be done by signing up for a Pan-African payments system that will promote trade across different continents.

The president of Kenya recently pleaded to his peers in Africa to stimulate central and commercial banks to join Pan-African Payments and Settlement System (PAPSS) which launched in January 2022.

The initiative of the Intra-African trade system was established by African Export-Import Bank (Afreximbank) and African Continental Free Trade Area (AfCFTA) Secretariat then substituted by the African Union and African central banks.

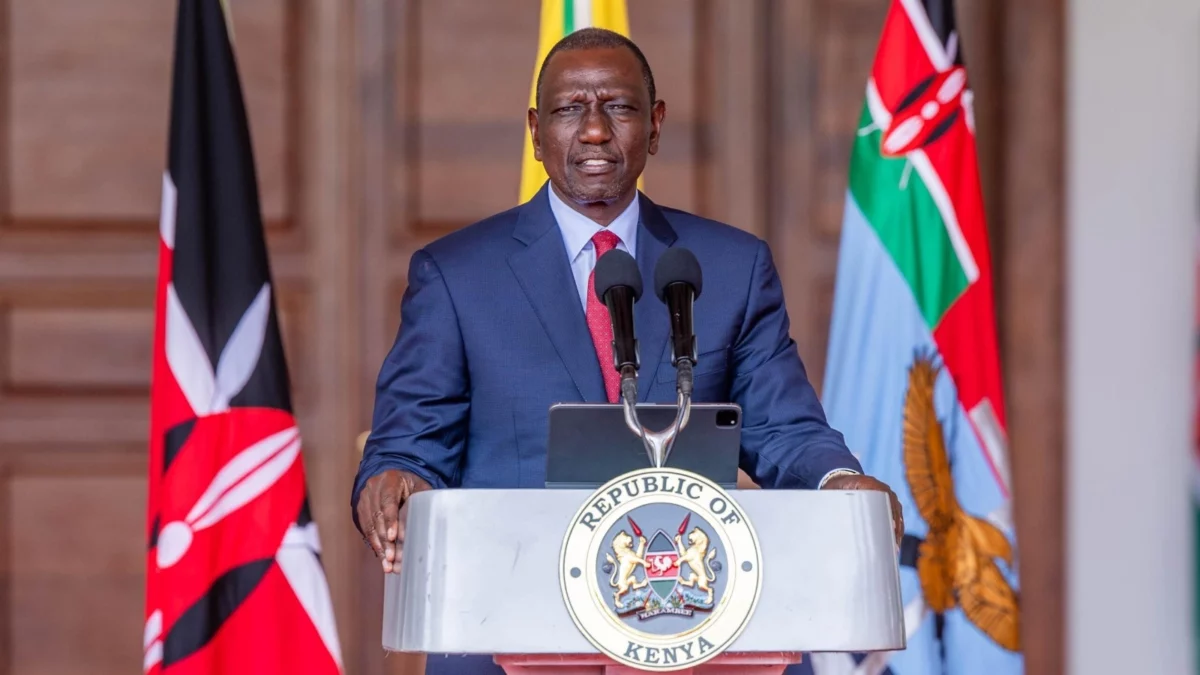

On Monday, during a forum attended by the government and private sector officials on AfCFTA, President Ruto said: “We are all struggling to make payments for goods and services from one country to another because of differences in currencies. And in the middle of all these, we are all subjected to a dollar environment,”

“There has been a mechanism where all our traders can trade in the local currency and we leave it to the Afreximbank to settle all the payments. We do not have to look for dollars; our businessmen will concentrate on moving goods and services, and leave the arduous task of currencies to Afreximbank.” He added.

Read Also: The Finance Bill 2023: A Closer Look at its Impact Beyond the Housing Fund Debate

The African traders use equivalent banks found in the US and Europe to finish payments between two African currencies mostly in dollars while other times using the Euro.

These transactions take approximately three to five days for the payment to get to the recipient’s bank with charges incurred for every transaction.

Since last year Oil marketers and manufacturers have had critics about an inconsistency in demand and supply of the US dollars, causing them to buy the dollar rate in batches and levels that are exceedingly above the official rate.

“I suggest that we have a mechanism where we can settle all our payments whether between our countries or externally using our [local] currencies. And we have a mechanism like the one that has been put up by the Afreximbank so that we don’t have to be hostage to any one currency,” President Ruto said.

“Without a single payment platform, payment instructions from one African country to another typically passes through several intermediary financial institutions, leading to increased costs, complications, problems and unnecessary currency fluctuations and it ends up being a whole ecosystem of confusion.” He added.

At the beginning of this month, the President of Kenya said our country conducted an artificial exchange rate market which caused a shortage in fuel supply that later on resulted in the distribution in portions, contradicting Patrick Njoroge, the governor of the Central Bank of Kenya.

Subscribe to our Youtube channel Switch TV

“We discovered there wasn’t a fuel [shortage] problem. It was a misdiagnosis. The problem was economic and much more a dollar problem.”

“Fuel had come but the oil marketers could not find the dollars to go and buy because the government was maintaining an artificial rate,” President Ruto mentioned.