House rent in Nairobi and satellite towns has dropped by a significant margin in a span of five years mainly due to reduced demand for luxury houses.

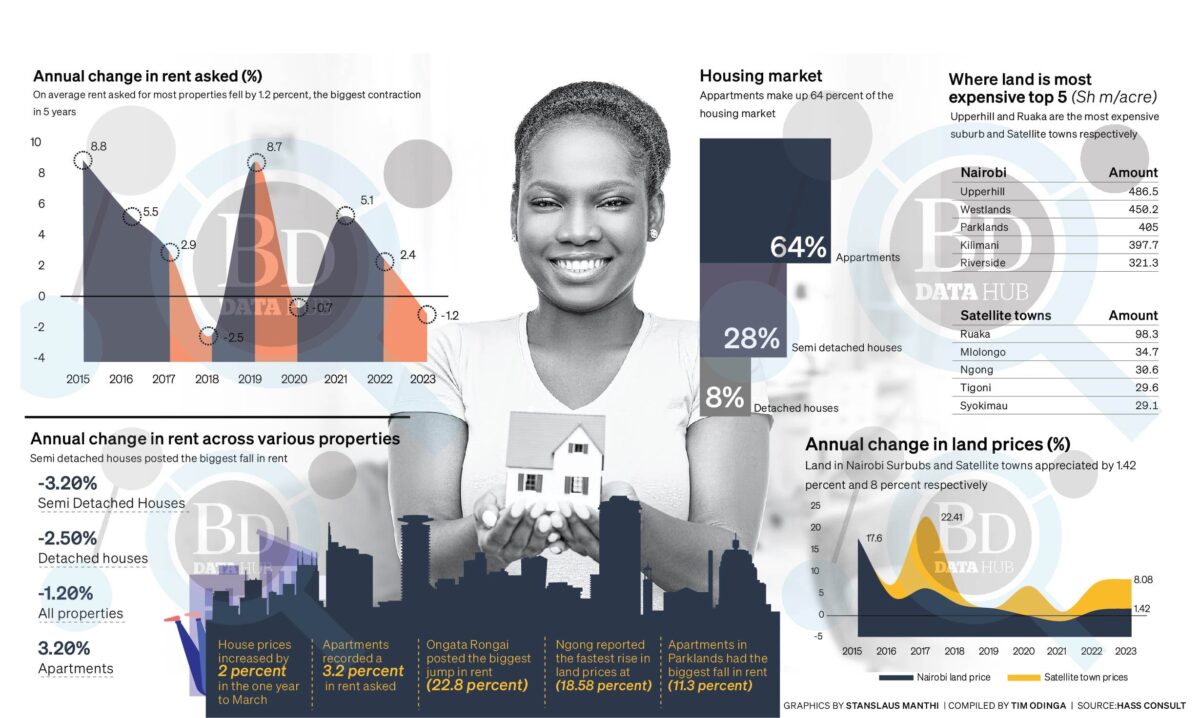

Real Estate firm HassConsult, reported that the average rent for residentials reduced by 1.2 per cent from January to March, in comparison to a growth of 2.4 per cent in a similar period last year.

This has been the greatest fall since 2018 when rental prices were reduced by 2.5 per cent during the electioneering period. The polls had investors worried over the outcome post-election.

Kenyans renting homes preferred going for less expensive apartments in the suburbs surrounding Nairobi owing to the decrease in demand for expensive homes in satellite towns resulting in lower rent prices.

Instead, workers who rent homes have chosen more affordable apartments in the suburban areas surrounding Nairobi such as Rongai, Syokimau, and Ruaka.

Apartments in the satellite towns resisted the trend to record a 3.2 per cent increase in the period under review on the back of increased demand for smaller units in the outskirts of Nairobi.

In the review of real estate trends for the period to March, HassConsult said: “Rental market experienced a decline but demand for affordable apartments particularly in satellite towns impacted returns”.

This resulted in a shift in investments in the real estate market, with property investors focusing on putting their money in apartments.

HassConsult reported that the share of apartments in the Nairobi property market has increased to 64 per cent while that of detached houses fell all of a sudden from over 50 per cent in the early 2000s and 28 per cent in 2016 to 7.5 per cent in March. Semi-detached houses account for 28.1 per cent of the market.

“Nearly all towns posted growth on apartment rental pricing, highlighting the increasing occupancy rate of apartments targeting renters with a monthly budget between Ksh 25,500 and Ksh 50,000,” added the real estate firm.

Since 2017, satellite towns continued with their bullish returns on land prices rising by 8.0 per cent this year to March being the highest return over the referenced period.

Read Also: Kenya is the 4th Richest Country in Africa

The increasing prices have been attributed to the towns’ affordability and improved infrastructure which have improved the attractiveness.

Ngong and Syokimau recorded the fastest jump at 18.6 per cent and 18.2 per cent at the end of the 12-month period while Ruaka remained with an acre averaging Ksh 98.3 million.

Over the period, land in Nairobi increased marginally by 1.4 per cent, Spring Valley rising greatly at 18.84 per cent.

Subscribe to our Youtube channel Switch TV