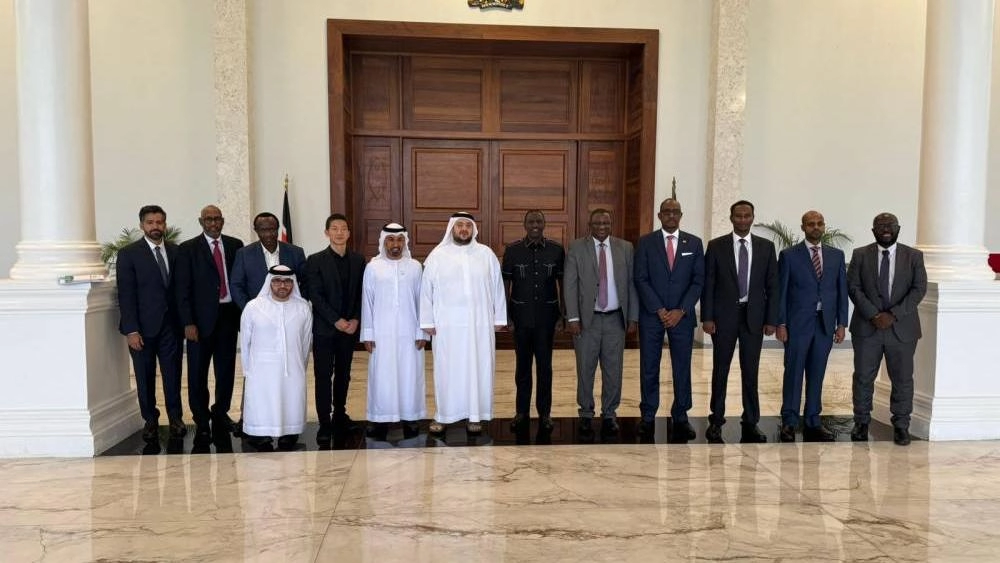

Mastercard has launched a new service tool, the Cross-Border Services, that enables financial institutions to make international transactions.

Availability of this feature will fasten cross-border payment which will be beneficial for consumers and businesses. The Cross-Border Services works with a digital overlay that is easy to implement and can be customized. It also provides additional tools to meet regulatory requirements and compliance.

Alan Marquard, Executive Vice President, Transfer Solutions at Mastercard said, “It’s our goal to provide choice, access, and transparency for payments across borders”.

“With a simple, turn-key integration, Cross-Border Services Express levels the playing field and provides small and mid-tier banks, including credit unions and community banks, with the same international payments features regardless of their size and scale.” He added.

The Mastercard Cross-Border Express services will enable participating financial institutions to offer their customers international payment services in more than 60 currencies to over 100 markets. This will cover 90 per cent of the world’s population.

Read Also: Equity Group Listed as the 4th Strongest Banking Brand in the World

This service also offers flexibility to users when delivering funds to bank accounts, mobile wallets, cards, and cash payout locations through full transparency and predictability over transaction status and delivery time.

In collaboration with Fable FinTech and Payall Payment Systems, the new service will provide market solution through a smooth user interface that meets customers’ increasing expectations for digital experiences.

The Mastercard 2022 Borderless Payments Report high growth in digital payments with three-quarters of consumers making payments through mobile apps. The only challenges that still exist revolve around transparency and costs.

39 per cent of SME respondents said that cross-border payments slow their supply chain and one quarter reported that suppliers had refused to work with them because of unreliable payment times.

Jane Prokop, Executive Vice President said, “For small and medium enterprises, it’s important to keep money flowing”.

“Cross-Border Services Express will enable financial institutions to meet SMEs’ needs for an efficient and digital cross-border payments solution they can count on to pay employees, suppliers, and partners fast and with full predictability.” She added.

Subscribe to our Youtube channel Switch TV