The Kenya Revenue Authority (KRA) has collected Ksh 5.8 billion through excise and collection of tax from betting firms since November 2022.

There was an introduction of daily collection of 7.5 percent excise duty on stakes and 20 percent withholding tax on winnings from the betting companies that led to data processing of taxes collected and the increase in revenue.

The records are from 16 betting companies which account for 90 per cent of the sector, who have been incorporated into iTax, the KRA online platform.

Before technology incorporation, the tax collector recorded Ksh. 5.7 billion in withholding tax (WHT) from winning bets. Through the availability of improved technology, the tax collector is expected to have double the collections since there is more visibility of instantaneous betting transactions.

Read Also: Google removes Kenyan Loan Apps from Play Store

On a sensitization forum concerning betting tax integration, KRA Chief Manager Domestic taxes Miriam Sila said the taxman is working towards integrating all betting companies to grow revenue collection in the sector.

“We are working on the third phase to integrate 20 more companies in our platforms to grow our collections, once this is done, we will have 96 per cent of the companies remitting excise and withholding tax on winnings daily,” she said.

Miriam observed that automation has contributed in getting extra revenue since the main challenges observed were visibility of real-time betting transactions and inaccessibility of betting and gaming transactions data.

“In the period before the automation, the transactions we could track stood at almost 50-60 per cent, we are now ant 90 per cent and hope to get to 100 per cent,” she said.

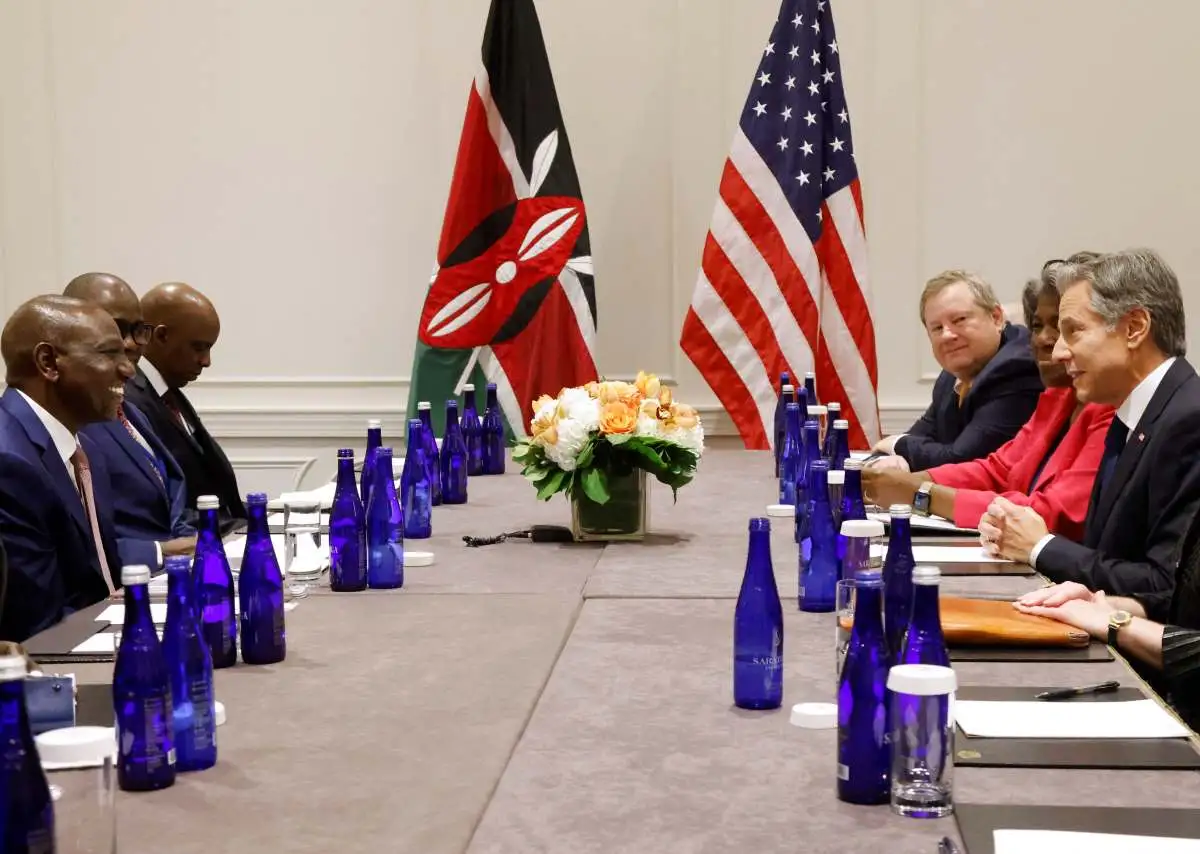

Last year September, President William Ruto encouraged regulatory authorities to dominate the online space because they were operating opaquely.

Subscribe to Switch TV for more content.

“That space needs much clarity and I am happy that the Central Bank of Kenya is taking steps to bring the actors in the online betting space to regulations so we can make them much more accountable,” Ruto said.

Kenya Revenue Authority (KRA) statistics have shown that the overall collections since June 2022 stand at Ksh 15.8billion, close to their financial target of Ksh 24 billion for 2022/23 financial year.