The need for climate action has been in the corridors of major conversations globally, due to the devastating effects of climate change, like the disruption of ecosystems and economies to name a few. As a result solutions are being fronted, ranging from carbon credits to cutting down fossil fuels emissions.

These discussions are continuously steered towards reducing emissions and decarbonizing economies. However, the urgent transformation needed to reduce absolute emissions is costly and takes time which is a scarcity in the journey to transformation to green energy. Arguably, carbon credits, which are measurable, verifiable emission reductions from certified climate projects to avoid or reduce greenhouse gas (GHG), are a frontier of climate action with a potential of leaps and bounds.

Research by Scientists at The Intergovernmental Panel on Climate Change IPCC has indicated that increased levels of GHG in the atmosphere are warming the planet. This creates extreme weather changes around the world, with the main drivers being the burning of fossil fuels- coal, oil, and gas.

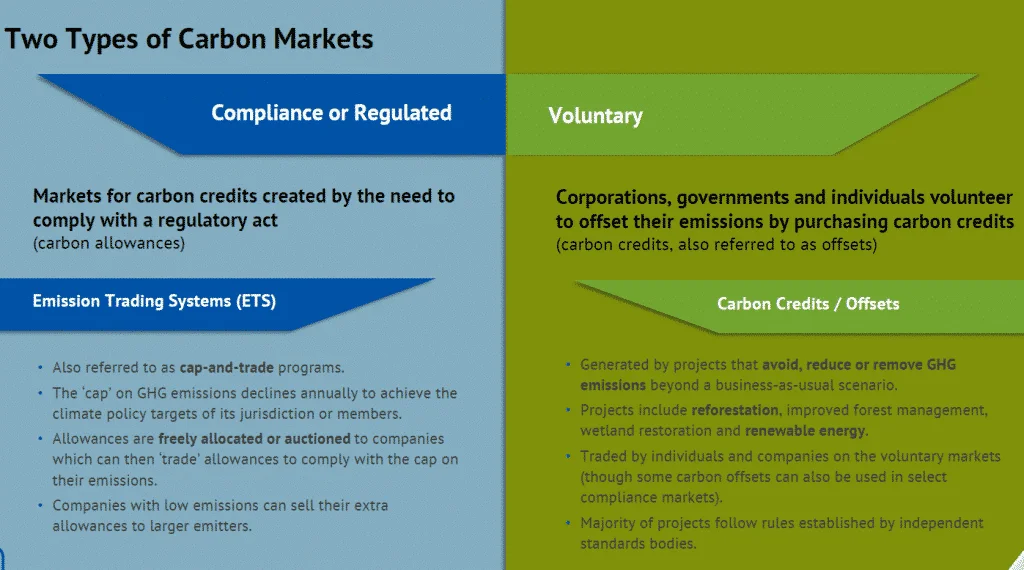

To ascertain success, climate action funding is an exceptional exercise. As a result, the pooling of funds through carbon credits has been increasingly adopted globally, in line with the 1997 International Climate Change Treaty; popularly known as the Kyoto Protocol, which brought about the system of ‘cap and trade’ as the world’s core intervention in addressing greenhouse gas emissions.

Now, ‘cap and trade’, refers to a scenario where the governments through regulatory bodies set caps on the amount of greenhouse gases that players in the economy can emit. Further, the cap is split into credits which are then sold to firms. In a situation where a firm owns credit in surplus, it can trade it to a player in the economy. Preferably, this will be reduced with every passing year to ensure that over time, the country transitions to, near-zero emissions of greenhouse gases that players in the economy can emit.

On September 1, 2023, President Ruto signed into law the Climate Change (Amendment) Bill setting the stage for the regulation of carbon markets in Kenya. This bolstered the nation’s ability to mobilize resources to strengthen climate action resilience initiatives and joined other countries globally including South Africa, India, Indonesia and Vietnam, signifying a positive commitment.

However, according to data from the World Bank, 308 million credits were issued in 2023, representing a 13% drop compared to 2022. The record high was 2021 with 362 million credits. The recent price slump clouds the outlook for the voluntary carbon market.

This new frontier in the global transition to green energy, even though greatly beneficial in its advantages to not only the environment but also to developing economies in the mobilization of resources, is greatly underutilized in the developing world.

According to experts who presented their research at a session on the Africa Continental Free Trade Area (AFCFTA), if fully implemented, it will considerably increase African Trade without adding significant pressure on Climate Change. Additionally, they further highlighted that whether establishing a single or several carbon markets in Africa, continental coordination through AFCFTA around carbon pricing is desired.

Seutame Maimele, an economist at Trade & Industrial Policy Strategies (TIPS), in his research paper on the European Green Deal and its impact on Africa, states, “The African Union within the AFCFTA could lead to the creation of regional carbon market which can be utilized for selling carbon credits. This market can also be used to retain the funds collected by the EU from the continent.”

Consequently, African Countries need to exploit this frontier in resource mobilization concerning global transformation to green energy. Mobilization of these resources to propel climate action and improve the economic status of vulnerable communities is a beacon of hope in the urgency to preserve our planet and secure the future of humanity.