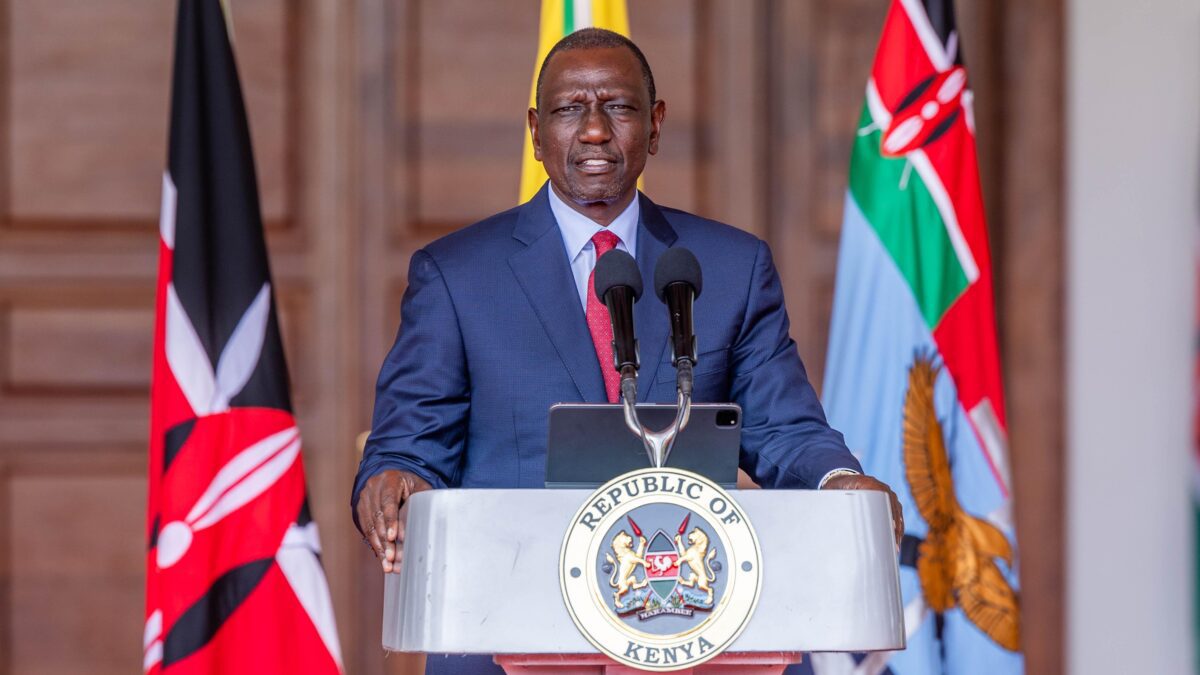

The National Treasury Cabinet Secretary of Kenya, Prof. Njuguna Ndung’u, has revealed a comprehensive plan to address the maturation of the country’s Ksh299 billion Eurobond, scheduled for June 2024.

The government’s approach involves reshuffling financial resources from various sources, including multilateral development banks like the International Monetary Fund (IMF) and the World Bank. Additionally, Kenya is engaging with bilateral partners, including friendly nations like Japan, and Development Finance Institutions (DFIs), such as SNBC, to alleviate its exposure to the Eurobond and mitigate market uncertainties.

“What we are trying to do is realign financial resources from multilateral development banks, which include the International Monetary Fund (IMF) and the World Bank. We are also reaching out to our bilateral partners including friendly countries such as Japan and others, Development Finance Institutions(DFIs) institutions such as SNBC. The idea is to reduce our exposure with the Eurobond and then contain the market jitters,” said CS Ndung’u.

The goal of this strategy is twofold: first, to ensure that any financial instruments Kenya taps into within the financial markets are complemented by available financial resources. Second, the government seeks to enhance its financial capacity to address pressing concerns, such as climate change, and drive its development agenda.

Read Also: Kenya eyes Eurobond to Cure the cash crunch

With the impending maturity of the Kenyan Eurobond in June 2024, many market observers expected Kenya to return to the global financial markets for refinancing. However, Prof. Ndung’u emphasized that the country is determined not to repeat past mistakes, opting instead to address the issues that have contributed to the current liquidity crisis.

He pointed out that Kenya’s debt structure has evolved, with the fiscal deficit growing from 4.4% to 5.6%. This increase is attributed to the appreciation of dollar-denominated debts. Prof. Ndung’u further noted the tightening of monetary policy by developed economies, which has reverberated in global financial markets. This trend has weakened currencies in the global South while strengthening the US dollar and other major world currencies.

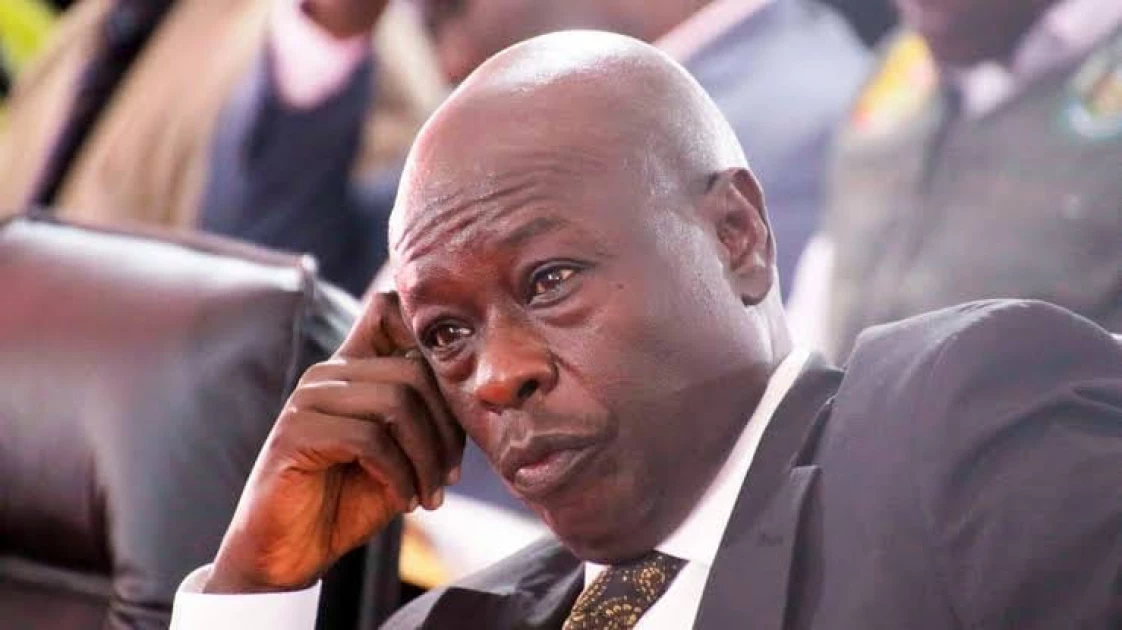

Last week, Reuters reported that Kenya is planning to repurchase up to a quarter of its US dollars 2 billion 2024 international bond before the year’s end, following the acquisition of new loans. Central bank governor Kamau Thugge informed Reuters about this move, which aims to alleviate concerns about the country’s ability to repay the impending debt.

Subscribe to our You Tube channel at Switch TV.

The nation has disclosed that it is currently in discussions to secure commercial loans ranging from US dollars 500 million (Ksh74.8 billion) to US dollars 1 billion(Ksh149.7 billion) from two regional policy banks, the Trade & Development Bank, and the African Export-Import Bank. Thugge revealed this information during an interview held on the sidelines of the World Bank and IMF meetings in Marrakech.