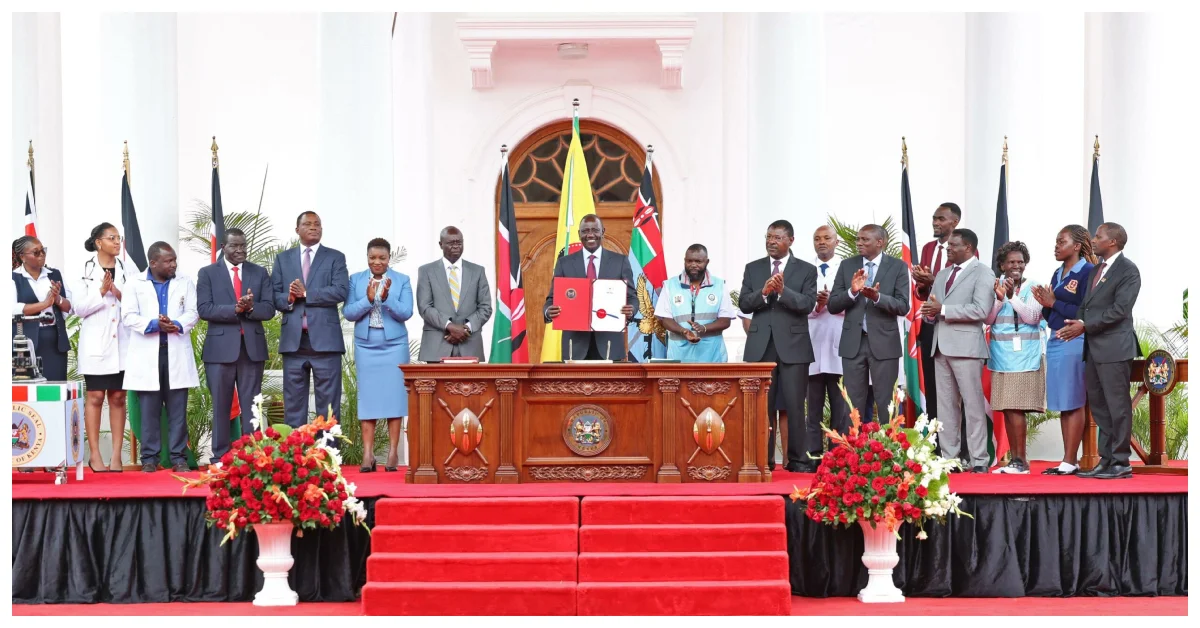

The Social Health Insurance Act 2023 has been officially gazetted, raising pertinent questions among employees and employers. Addressing these concerns is therefore crucial for clarity and understanding. Some of the key aspects of the legislation include;

Implementation Timeline

One common query revolves around the commencement of deductions. Contrary to initial expectations, deductions will not begin in November 2023. The gazette notice serves to bring the new social health insurance into effect, but the actual deductions await the publication of accompanying regulations.

Contribution Rates

Concerns about the financial impact of the new legislation are widespread. The deduction rate has been set at 2.75% of wages. Despite initial indications of a cap at Ksh5,000.00, the President emphasized during the launch that there would be no capping. This implies that 2.75% of an individual’s wages will be allocated to the new health insurance fund.

Employer Contributions

Employers are not exempt from contributions. As outlined in Section 27(1)(e) of the Social Health Insurance Act 2023, both employees and employers are mandated to contribute. Employees will contribute 2.75%, and employers are expected to match this contribution.

Inclusion of Casual Workers

The scope of contributions extends to casual workers, who will be subject to deductions as outlined in forthcoming regulations. This aligns with the precedent set by the Affordable Housing Levy (AHL), where casuals were also mandated to contribute.

Opting Out for Employers

Unlike the NSSF Act, which allows employers to opt out, the Social Health Insurance Act 2023 provides no such option. The emphasis is on creating a unified fund to ensure comprehensive medical coverage for all citizens.

Probable Deduction Start Date

All signs point to deductions taking effect from January 1, 2024. Employers are advised to factor this into their budgetary considerations.

Read Also: Proposed Social Health Insurance Bill: Strict Penalties and Reform Initiatives

Impact on In-House Medical Covers

If employers are compelled to match employee contributions, the cost implications may affect existing in-house medical covers. This could necessitate a review of medical cover strategies and innovative solutions.

Overhaul of National Health Insurance Fund (NHIF)

The Cabinet approved the repeal of the NHIF, replacing it with three distinct funds: the Primary Healthcare Fund, the Social Health Insurance Fund, and the Emergency, Chronic, and Critical Illness Fund. This restructuring aims to address issues of corruption and inefficiency within the NHIF.

Inclusion of Non-Kenyan Residents

The Act extends eligibility to non-Kenyan residents, provided they have been residing in the country for more than 12 months. Short-term residents (less than 12 months) are required to have travel health insurance coverage.

Stringent Measures Against Fraud

To combat fraud, the Act introduces punitive measures. Suspected individuals engaging in fraudulent activities risk imprisonment for five years, a fine of Sh1 million, or both.

Transfer of NHIF Balances

The NHIF is mandated to transfer all cash balances to the newly established Social Health Insurance Fund.

Subscribe to Switch TV for more exciting content

Universal Coverage for Newborns

All children born in the country will be automatically registered as members of the Social Health Insurance Fund, ensuring immediate access to healthcare services.

Public participation is however expected during the enactment of the legislation.