The Kenya Shilling faces a challenging year as the sixth weakest African currency against the US Dollar, with a devaluation of over 15%. In the recent Forex session, the Kenyan currency depreciated against the dollar, reaching Ksh145.15 from Ksh144.99 previously.

Year-to-date, the shilling weakened by 17.65% against the dollar, compared to a 9.04% depreciation in 2022.

The devaluation coincides with Kenya’s implementation of the Finance Bill 2023, introducing new taxes like the Housing Levy and Digital Tax. The country also adjusted income tax brackets, focusing on higher earners.

During the first half of this year, the Kenya Shilling depreciated by 13.94% against the US Dollar, ending at Ksh140.52. In contrast, the decline was 4.16% during H1 2022, with an exchange rate of Ksh117.83.

The devaluation is attributed to the US Dollar’s strength against emerging market currencies, higher global commodity prices driving dollar demand, and reduced dollar earnings from agricultural exports.

The continuous Dollar strengthening against developing nation currencies, combined with foreign debt repayments, may pressure foreign exchange reserves.

Read Also: Kenyan Shilling Further Declines at Ksh 150 Against the Dollar

Anticipated dividend repatriation and increased dollar demand in the equities market in Q3’23 could escalate demand. On the other hand, dollar investments through Foreign Direct Investments (FDIs) and capital inflows in the Nairobi Securities Exchange (NSE) could support the Kenyan Shilling.

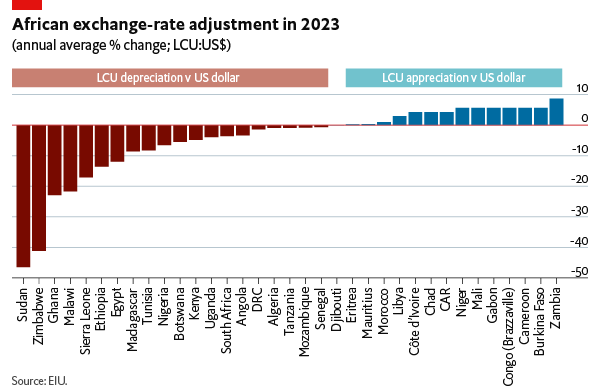

The Nigerian Naira is the weakest African currency this year, depreciating over 40% against the US Dollar. This follows Nigeria’s efforts to reform its foreign exchange regime and discontinue the fuel subsidy program.

Subscribe to Switch TV for more exciting content

The Angola Kwanza follows with a 39.5% decline against the US Dollar, then the Egyptian Pound (20.6%), Congolese Franc (18.9%), Liberian Dollar (18.6%), and others including the Kenya Shilling (15.7%).