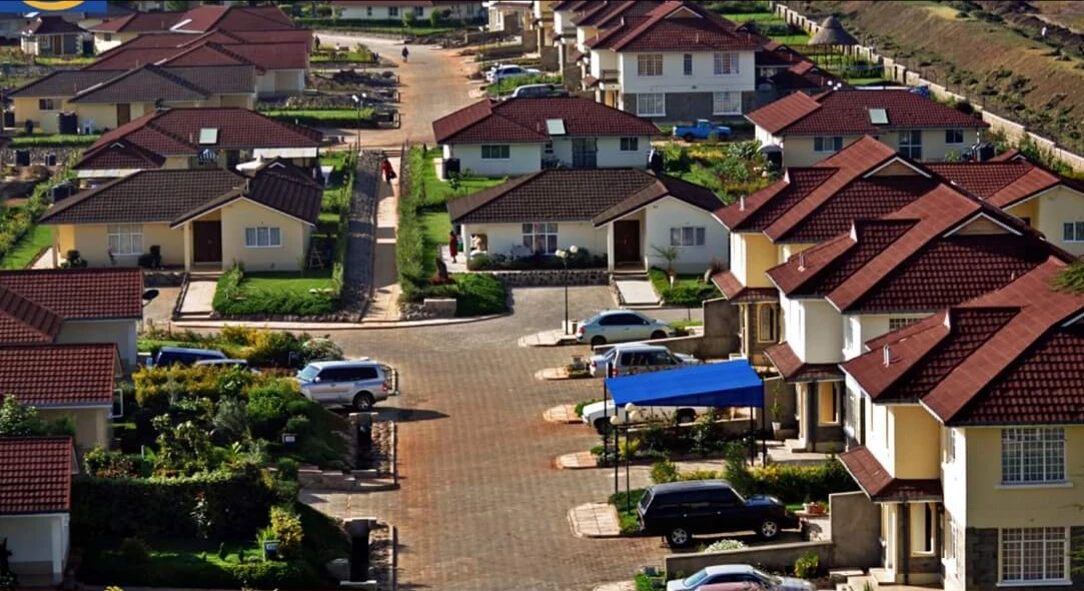

Kenyans hardly know the hidden pitfalls of Kenyan Real Estate Market. The one thing they love and hold so much regard for is land and real estate,associating wealth with land and real estate. They, however, get into it without knowing the possible failures.

One challenge in real.estate that many don’t realize is that occupancy will not always be at 100%. You find people building large rental houses or estates expecting people to inhabit in seconds and returns to overflow. Sadly, sometimes the houses remain empty for too long and don’t get an occupant.

Not every land you have can thrive under real.estste. since we associate wealth with real.estate, you find that people don’t survey their surrounding to determine whether people will.want to live there. In the end, you have a big investment but no occupants to return the capital since the place you built isn’t attractive to many. Could also be that your pricing is too costly for the neighbourhood.

Returns are not always set after a tenant occupies as house. There are instances where they leave without notice leaving you to do repairs. Other instances, they leave you with high water and electricity bills and now only you cab pay them. In the process of repairing, you chip into your returns and keep.spending without getting the benefits.

Deposits don’t always offer the safety they ought to give. Payment of deposits is meant to repair the house upon tenant’s moving out and if it remains, repaying the tenant. When deposits are paid, they don’t factor in inflation. The price paid today could lose so much value in a few years. This means that the repairs will.have to be done out of pocket and not through deposits in the first place. Other times the tenant has damaged the house beyond salvaging that the deposit is not enough to cover repairs.

A few crucial things to remember before investing in real estate:

— Gichuki Kahome (@kahome_steve) June 18, 2023

1. Occupancy levels will not always be 100%

2. Repairs will eat into your returns.

3. Be ready to deal with tenants who don't pay rent on time.

4. Even bonds will give you higher returns than most RE projects

Late rent payment from tenants is and aways will be a problem with real estate. Many think that real estate can’t be affected by rising cost of living. In real.sense, high cost of living means more money spent on essentials like food. The balance pays school fees for the children. At the end of the day, the tenant doesn’t pay the rent and could even stay up to 3 months without paying. Having to evict them seems like a solution, but they won’t pay the three months rent and the bills they garnered. Eviction doesn’t guarantee occupancy of the vacant house as well.

“Stagnant rate of rent vi’s a vi’s inflation. Getting 90k a month since 2014 seems good until you factor in inflation,” Gitonga Gideon tweeted.

The reality is that, rent doesn’t always appreciate with time. The land beneath it may continue appreciating, but the house built on it may stagnate. Tenants will not be comfortable with rent increase and go ahead to threaten moving out. In response to this, landlords often opt to maintain the tenant and receive the little return just for the assurance of occupancy.

Additionally, real estate will not guarantee payment of investment loan taken out. Many Kenyans today and taking out loans and investing in real.estate. this however doesn’t offer the safety of repayment. Tenants delay to pay rent, there’s no guarantee of occupancy, and also stagnant rental pricing. With this, it can either harm the repayment schedule or hinder it entirely.

There are other ways to make returns that real estate. Most bonds give you better returns than real estate in the first place. Considering the risk on f no occupancy, using returns for repairs and wrangles with twnenats, other options seems better than real estate. Options such as bonds or stocks.

Real estate, however glorified, isn’t as sunshine and rainbows as presented. There are other people who have thrived in the sector though.

Read Also: Climate Change Knocking Out Pastoral Communities in Kenya