Prices on fuel are set to go higher after 180 MPs vote for a fuel VAT increase to 16%. The prices are set to increase by approximately Ksh 10.62 as of July 1 2023.

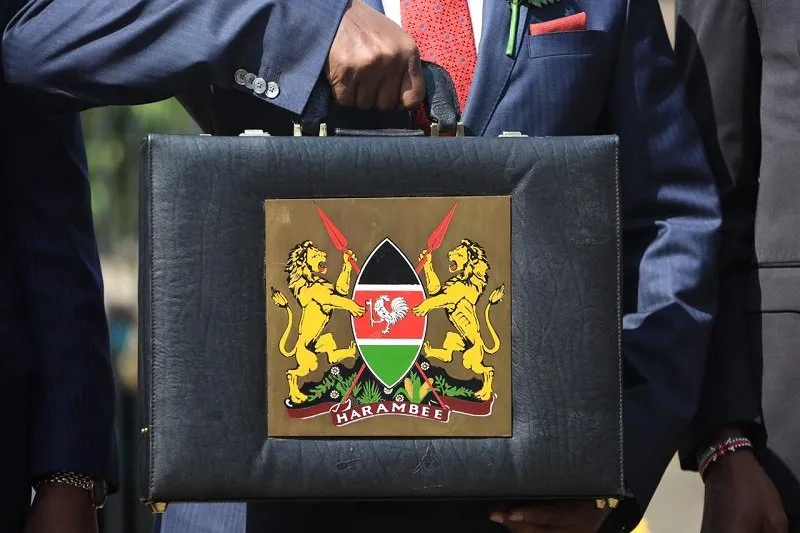

On Wednesday 20, 2023 in the afternoon, the Members of Parliament met at the National Assembly to debate on the proposed finance bill. This would be the third reading of the finance bill after amendments had been made. They came to an agreement to increase the standard rating Value Added Tax on petroleum products.

In the entirety of the debate, Azimio MPs tabled petitions and amendments that were shot down by the majority of the MPs in the house. 184 MPs endorsed the proposed Finance Bill 2023 on the revision of VAT on fuel from 8 per cent to 16 per cent.

Alongside this decision, they reduced the Import Declaration Fee (IDF) from 3.5 per cent to 2.5 per cent. Reduction of Railway Development Levy (RDL) from 2 per cent to 1.5 per cent.

During the discussion, the majority of Kenya Kwanza MPs supported the decision to increase VAT on grounds of revenue increase. They are angling for increased tax revenue of 50 billion from the increased fuel VAT.

Subscribe to Switch TV for more content.

In support of this, they claim that low VAT created room for multiple fuel rates to exist. This created space for exploitation from rogue players and cartels that burdened the taxpayers. Buying fuel at a lower price and selling it to citizens at a higher price. Increased VAT ensures the protection of these industries and shelters the taxpayer.

According to the latest Pump Price review by the Energy and Petroleum Regulatory Authority (EPRA) carried out on June 14, prices would be different from the present. One litre of super petrol is set to increase from Ksh 182.04 to Ksh 193.50. One litre of Diesel is also set to increase from Ksh 167.28 to Ksh 177.69. Finally, the kerosene is set to increase from Ksh 161.48 to Ksh 171.46.

With increased VAT on fuel, other areas are bound to be affected. Prices of public transport are set to increase either by road or by air. The price of commodities would increase due to the cost of transportation involved in the acquisition process. This among all other sectors is bound to increase in cost. Tough times are ahead for Kenyan Citizens following the increased VAT on fuel.

Read Also: Impacts of Finance Bill On the Private Sector