Kenya’s Banking Industry’s balance sheet size amounted to Ksh 6.5 trillion as of December 31 2022, in correspondence to the 66 per cent Gross Domestic Product (GDP) for the same period.

The 2023 report by Agusto Market Intelligence, says the banking sector’s growth during the past decade has been credited to the rising virtual banking solutions, significant investments in technology infrastructure and booming mobile money systems.

The report mentions that Kenya’s Banking Industry remains sturdy in spite of the present harsh macroeconomic conditions and it plays an essential role in the country’s economy. Kenya’s economy is the largest in the East African region with a Gross Domestic Product (GDP) of about Ksh9.9 trillion in 2022.

Read Also:Kenya’s Banking Industry Creates Job Opportunities

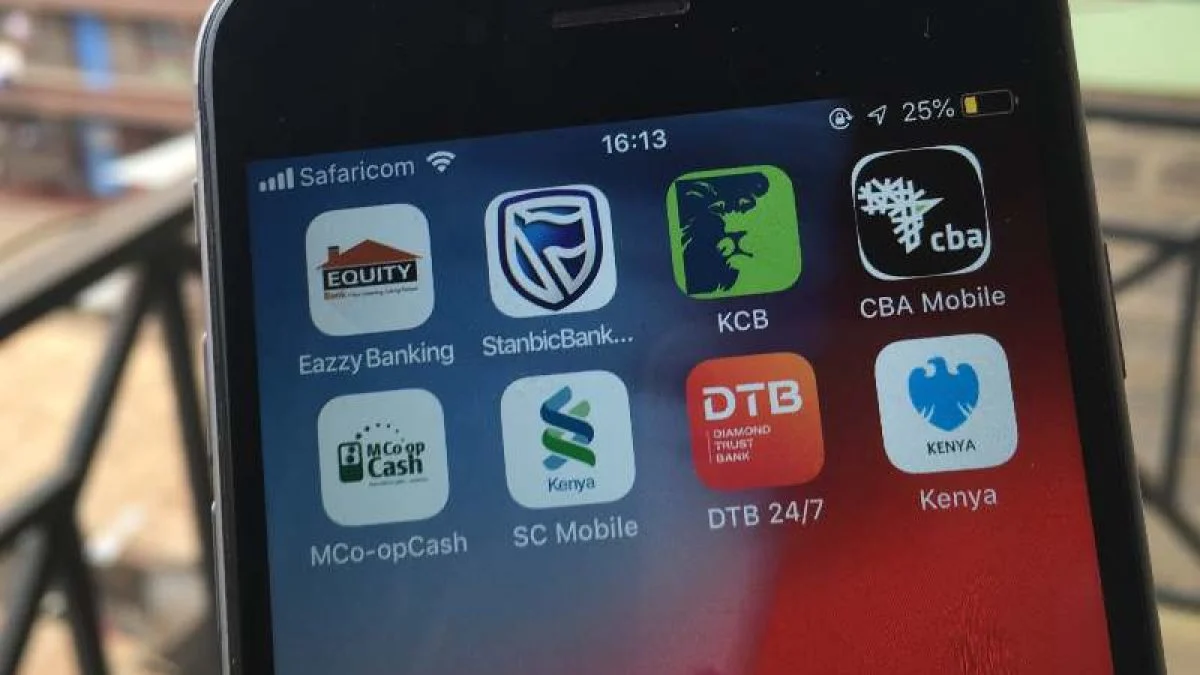

Of all the digital services, Kenya’s mobile banking space is the strongest with over 73.7 million registered mobile money accounts.

Staff cost is the single largest expense at 47 per cent of total operating expenses in Kenyan banks. Government securities take up 31 per cent of the whole industry’s balance sheet. The biggest contributor to non-interest income is Forex Trading at 39 per cent.

Subscribe to Switch TV for more content.

There are however vast opportunities that have not been fully exploited according to the report.

Development of more sustainable financial offerings and providing new services such as bank assurance, while growing the digital banking solutions space will further improve returns in Kenya’s Banking Industry.