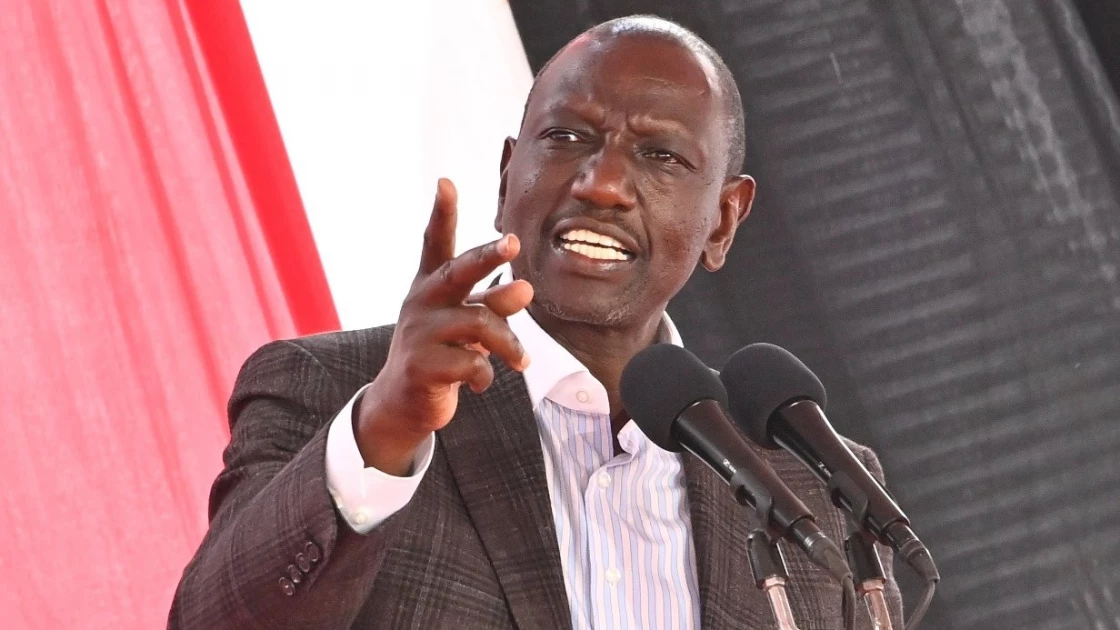

President William Ruto has implemented stricter criteria for accessing the new business loan facility Hustler Group Loan. To qualify for the Hustler Group Loan, individuals are now required to settle their existing personal loans, as defaulters will be ineligible for this opportunity.

The President expressed concern over the escalating default rates in the country, which currently stand at 29 percent nationwide. He emphasized the government’s commitment to ensuring that all borrowers repay their loans, with no exceptions.

Those with outstanding debts to the Hustler Fund will not be eligible for a share of the government’s allocated Sh10 billion funds aimed at supporting businesses. The loan amounts for groups range from Ksh20,000 to Ksh1,000,000 for the Hustler group loans, but prior settlement of owed amounts is mandatory.

The loans are offered at a 7 percent annual interest rate, with a repayment period of six months from the loan issuance date. Repayment options include installments or a lump sum, and the loan is accessible to groups with a minimum membership of ten individuals.

Read Also: Hustler Fund’s Loan Default Challenge in Kenya

He added that a significant number of individuals have been removed from Credit Reference Bureaus (CRB) due to loan repayment defaults as a way of fighting poverty in the country.

President Ruto announced in July of this year that individuals who have defaulted on individual loans will face restrictions when seeking group funding, the second offering from the Hustler Fund.

Subscribe to our Youtube channel Switch TV

He emphasized that defaulters will not be permitted to engage in further transactions if they have unresolved payments within the platform. These regulations reflect a concerted effort to ensure responsible borrowing practices and support sustainable economic growth in Kenya.