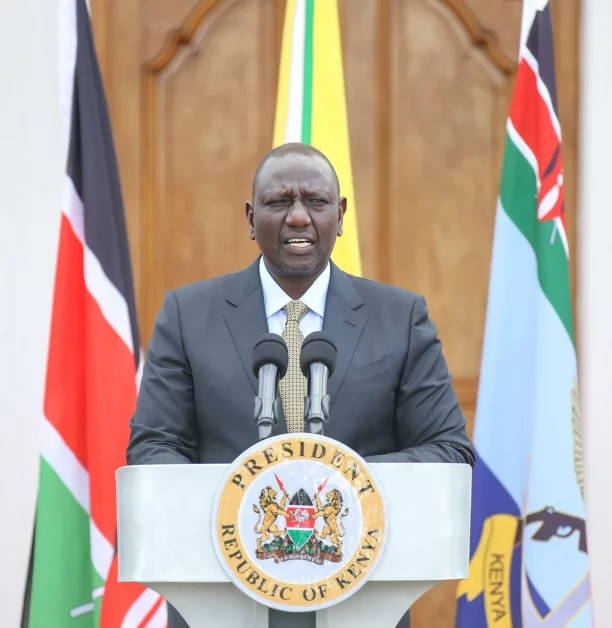

President William Ruto in his Mashujaa Day speech set a condition for the “Hustler Fund” that hustlers will have to participate in a pension programme for them to access the cheap credit offers.

President Ruto’s conditions raised mixed reactions to millions of Kenyans who were eagerly waiting for the biggest campaign promise of Ksh50 billion he pledged to give to all hustlers across.

“All borrowers on this platform will also participate in a short-term savings plan and long-term pensions programme. Every saving made by borrowers on this platform will be merged by the government of Kenya on a 2:1 ratio to a level to be determined by the programme,” Dr Ruto said.

According to Ruto, the program is an ultimate plan by the government to grow pension contributions in the extension of its recent efforts to put increase the National Social Security Fund from the ongoing Ksh 200 to Ksh 2000 which the Highcourt blocked.

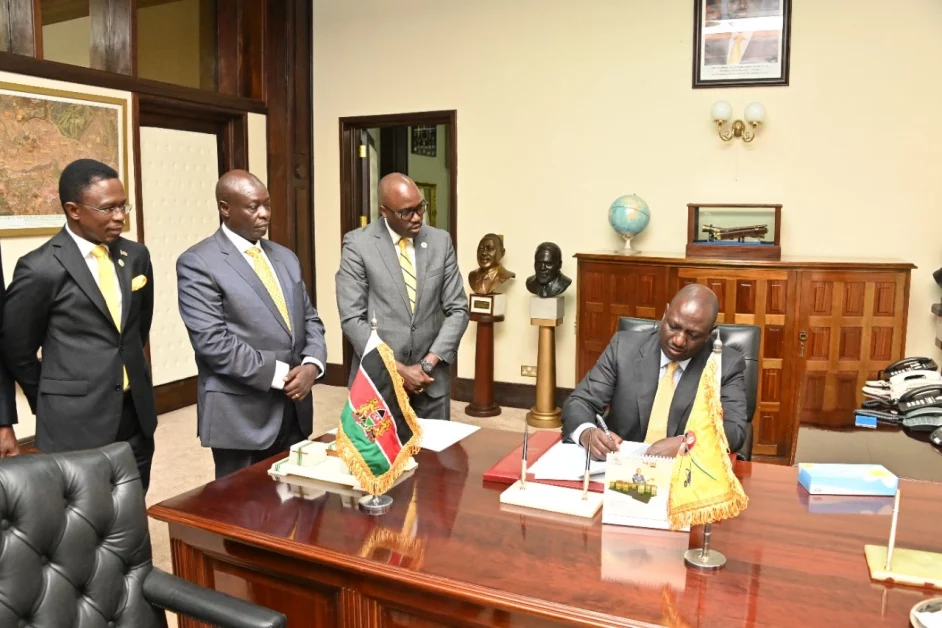

He gave out these conditions while stating that on December 1st he will officially launch this programme yet to begin.

These conditions were not clear before and have had different impacts on individuals and different sectors.

Some have been encouraged or discouraged from the disbursement of this cheap credit to sectors and individuals who have been left out for a long period of time in our economy.

The conditions will be more clear and people will be able to understand much more when the programme becomes operational.

“Already, expectations are very high across the country on our promise to provide a fund that will offer affordable credit to those at the bottom of the pyramid. We are aware that the most significant question in the streets, boda boda parking lots and fresh produce markets are: when will the Hustlers Fund become operational? I have an answer for you today. I will launch this Hustler Fund credit and savings product on the 1st of December this year,” the President said in his Thursday Mashujaa Day speech.

Click here to subscribe to our YouTube channel at Switch TV

“Credit products will be available to small businesses on digital platforms at affordable rates to individuals and through chamas, groups, SACCOs and Cooperatives,” he said.

He promised that no citizen will be left out of the credit system, they will be able to access the funds as they work out to pay their loans.

Read Also: