In November 2022, the members of the National Assembly approved the introduction of five new taxes effectively widening the country’s tax bracket.

In the supplementary budget, the MPs increased the Personal Income Tax Rate collected from individuals and imposed on different sources of income like labor, pensions, interest, and dividends.

“The benchmark we use refers to the Top Marginal Tax Rate for individuals. Revenues from the Personal Income Tax Rate are an important source of income for the Government of Kenya,” National Assembly Budget and Appropriations Committee statement read in part.

Among the taxes that were introduced, taking effect from January 2023, included Capital Gains, transfer of unquoted shares and rights, bank-to-mobile transactions, mobile-to-bank transactions, and digital content.

Capital gains tax when you transfer property

The law defines Capital Gains (CGT) as a form of tax that is levied on the transfer of property situated in Kenya, acquired on or before January 2015.

According to the government, Capital Gains Tax is declared and paid by the transferor of the property, and not necessarily the receiver.

The initial rate of Capital Gains Tax was 5 percent of the total value of the property, but it has since been increased.

Capital Gains Tax is computed by exempting incidental costs on transfer from transfer value.

“If the property is sold, exchanged, conveyed or otherwise disposed of in any manner (including by way of gift), it is still considered as part of those that fall under Capital Gains Tax (CGT,” the government website explained.

Transfer of unquoted shares and rights

Individuals transferring unquoted shares from one person to another within a company are required to pay Capital Gain tax on the difference between the sale consideration received and the cost of acquisition of such shares.

Currently, Kenyans transferring unquoted shares and rights will have to pay a 15 percent tax on the total value.

“It is important to check if the ‘Sale consideration’ that he receives from the buyer is at least equal to or more than the “Fair Market Value” (“FMV”) as defined under Rule 11UA of The Income Tax Rules, of the shares sought to be transferred,” the government website explained.

Read Also: Comic Comedian Impersonate Ruto Mocking the Bottom-Up Agenda

Mobile to Bank Transactions

Members of the National Assembly restored the Finance Bill 2018, which saw Kenyan mobile money and internet users pay a 15 percent excise tax on internet services.

The Finance Bill also required Kenyans to pay 20 percent on mobile money transfers.

Bank-to-Mobile Transactions

Kenyans who are transferring money from banks to mobile money wallets are currently parting with a 20 percent tax on the transaction.

Digital Service Tax

Technology firms are currently charging Digital Service Tax at 16 percent rate for any transaction conducted on the internet.

The digital services include video conferencing, streaming, or listening to music on the Internet.

Article 221 of the Constitution allows Parliament to regularise government expenditure that has not been approved within two months of the first withdrawal from the National Treasury.

Subscribe to our You tube channel at Switch Tv.

The new taxes will have immense pressure on Kenyans’ financial capabilities, especially, those on basic salaries.

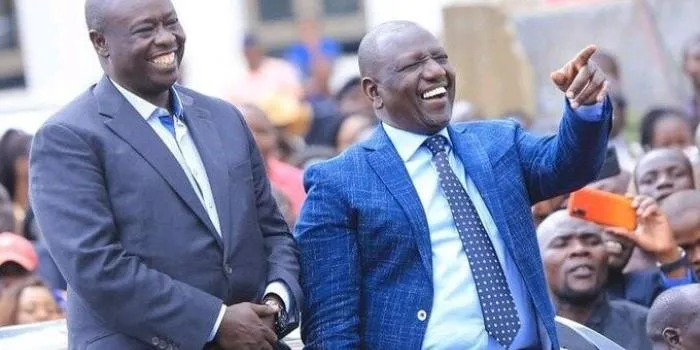

President William Ruto on Wednesday, January 4, re-affirmed the government’s commitment to ensure that all Kenyans pay their taxes.

The head of state ordered the revenue authority to double its revenue collection, to raise at least Ksh3 trillion by the end of the 2022/2023 financial year.