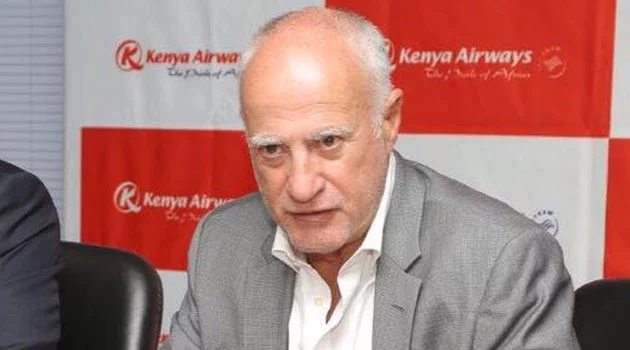

Kenya Airways Chairman, Micheal Joseph has refuted the allegations made by deputy President Rigathi Gachagua over what he says that the company is set to benefit few individuals, terming it as “state capture.”

Michael said the company is working under set procedures and that Gachagua’s statement is erroneous.

In an interview with Citizen TV, Gachagua alleged that KQ’s losses were caused by faulty contracts that they had signed to help a limited number of individuals who he claimed were involved in state capture.

“We have had very serious discussions with Kenya Airways. Their planes are always full, and they have the highest fares in the continents yet they make losses because of state capture. Because the people who lease the air crafts overcharge Kenya airways because of state capture,”

“We are dealing with that so that we can bring the operational cost of KQ so that we can begin making profits,” he said.

Follow us on Twitter at Switch Media Kenya.

However, the KQ chairman dismissed the claims and stated that the contracts by the airline are purely commercial business agreements whose aim is to benefit the airline.

He added that the National carrier had engaged in lease agreements with well-known foreign firms that oversee the leasing of hundreds of aircraft to several foreign airlines globally.

He further denies the claims that they were overcharged for key services offered to the airline.

“The costs are within the prevailing market rates at the time of negotiating the transactions.”

According to Wikipedia, Kenya Airways Ltd. which is commonly known as Kenya Airways is the flag carrier airline of Kenya.

The company was founded in 1977, after the dissolution of East African Airways.

Its headquarter is located in Embakasi, Nairobi, with its hub at Jomo Kenyatta International Airport.

The airline was owned by the Government of Kenya until April 1995, and it was privatized in 1996, becoming the first African flag carrier to successfully do so.

Kenya Airways is currently a public-private partnership. The largest shareholder is the Government of Kenya (48.9%), with 38.1% being owned by KQ Lenders Company 2017 Ltd (in turn owned by a consortium of banks), followed by KLM, which has a 7.8% stake in the company.

The rest of the shares are held by private owners; shares are traded on the Nairobi Stock Exchange, the Dar es Salaam Stock Exchange, and the Uganda Securities Exchange.

Also also: