The new zero-interest credit program from Safaricom will enable millions of its users to shop for items worth up to Ksh 100,000 and pay later. Debt collectors will be used to seek overdue debts.

With the help of debt collection companies, thousands of borrowers could have their property seized.

|

|

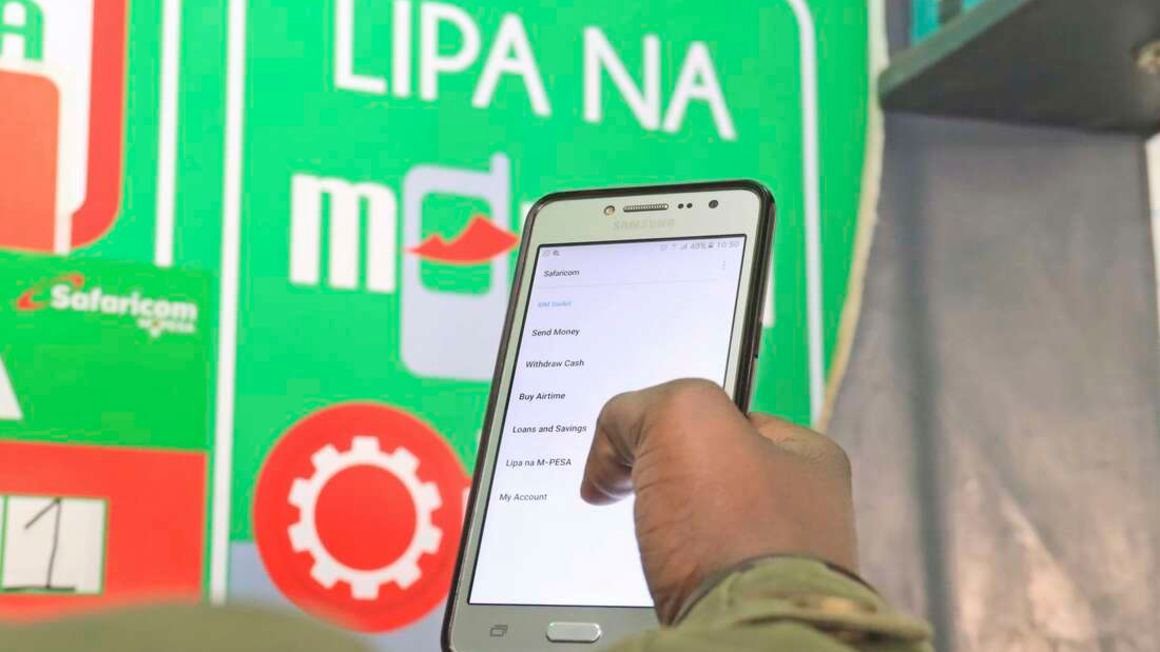

A Lipa na M-Pesa till number on display. Image: [Courtesy] |

In a market where mobile loans have a high default rate, this will be the first time Safaricom has used debt collectors for its lending products, which include M-Shwari and Fuliza.

Safaricom has used the threat of placing defaulters on the credit reference bureaus’ (CRBs’) blacklist to recover outstanding loans and reduce defaults.

Borrowers who have been reported to one of Kenya’s three CRBs put their chances of receiving more credit in jeopardy.

The latest mobile loan products’ inclusion of debt collectors is a hint that Safaricom is stepping up its attempts to improve payback.

According to the results of a recent household survey conducted by the Central Bank of Kenya (CBK), FSD Kenya, and Kenya National Bureau of Statistics (KNBS), 50.9% of respondents had mobile loan defaults.

The rising defaults happened at a time when online lenders swamped Kenya with high-interest loans with annual percentage rates as high as 520 percent.

A loan default, according to the poll is any missed or late payment or no payment at all.

Without collateral, digital loans and mobile banking are subject to default by borrowers.

The higher risk of default is due to the fact that they are frequently used as an emergency measure by people or businesses who are short on cash.

With lenders mainly relying on algorithms that create a financial profile of consumers to reduce the risk of default, many Kenyans now discover that they may obtain loans in only a few minutes.

The apps analyze borrowers’ personal information on their phones, including contacts, mobile money transactions, social media footprint, and browser history, using algorithms to determine how creditworthy they are.

Users of the interest-free Faraja product can spend as little as Ksh200 and as much as Ksh 100,000 on goods and services while paying the same amount without the extra fees associated with conventional credit products.

As opposed to Fuliza, transfers from the Faraja account can only be used to pay for things through Lipa na M-Pesa, hence subscribers are unable to send money to other users.

Safaricom will be paid through Lipa na M-Pesa charges, which vary in price from Ksh 23 to Ksh 210 depending on the size of the transaction.

In the case of payments made by drivers at gas stations, the fees are either totally covered by the sellers or buyers or co-shared with the customers.

Expenses related to hiring debt collectors will also be borne by defaulters. A defaulter’s Faraja account will be suspended or terminated by Safaricom.

Faraja is expected to disrupt the mobile loan industry and undercuts more expensive credit products like its own Fuliza, KCB Mpesa, and M-Shwari as well as those from digital credit providers like Tala, Branch, and Zenka.